A harsh (too harsh?) market verdict on News Corp’s quarterly numbers

Welcome to a midweek edition of Unmade. Today: News Corp’s financials spook the market.

In everything we do with Unmade, we try to go beyond what’s handed to us on a plate. The data you see below has been collated by Unmade from analysing years of financial reports.

You can show your organisation’s support for our independent journalism by signing up to Unmade as a paying member.

Is News Corp result a signal of tough times ahead?

Yesterday’s quarterly financial results from News Corp weren’t bad. Indeed, for Australia, they were quite good. But the financial markets didn’t like them, and the company’s share price fell by 11.5%, on a day Wall Street was down by only 2%.

With News Corp reporting across multiple divisions and countries, it’s often hard to sort the signal from the noise. That’s particularly the case when it updates the markets in US dollars, but big chunks of the company’s revenues arrive in UK pounds and Australian dollars. In the quarter just gone, one Australian dollar was worth 68 American cents. A year before, that number was 74 cents.

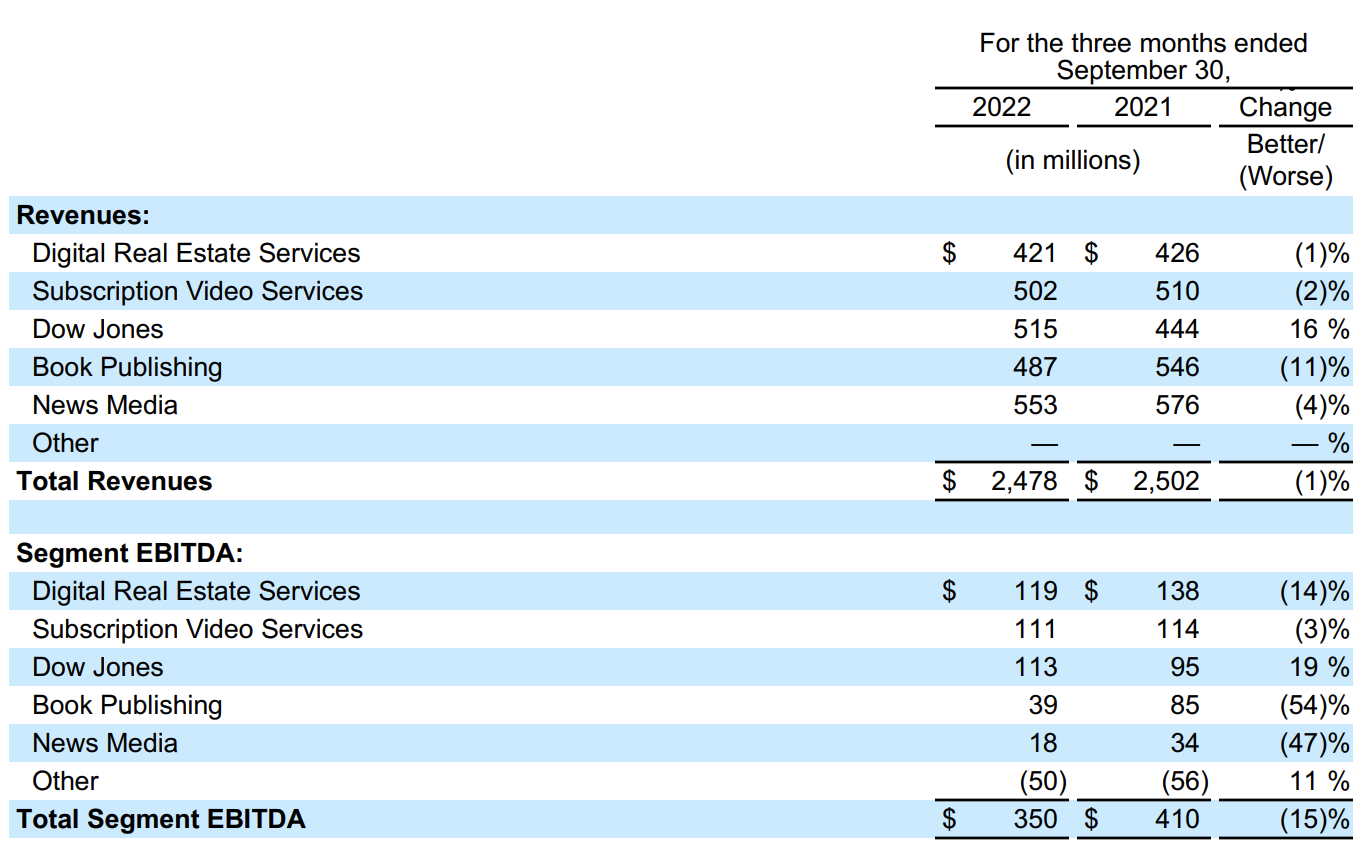

Nonetheless, the headline is the headline, and in this case News Corp saw its headline quarterly profits fall by 15% to US$350m for the quarter.

Within that number, the company’s HarperCollins book publishing division fared worse – with revenues down 11% and profits slumping by 54%. The division was screwed over by Amazon changing its inventory policies along with the increasing cost of printing books.

But the profit drop from News Corp’s news media division wasn’t far behind, falling by 47% to US$18m.

Sticking with the news media segment, News Corp CEO Robert Thomson announced yesterday that News Corp Australia had hit the impressive milestone of 1m digital subscribers. That included 929,000 to the company’s news mastheads – The Australian along with the metro tabloids. That’s up from 850,000 the year before.

On constant currency, News Corp’s Australian circulation and subscription revenue was up by 3%, while advertising was up by 11%.

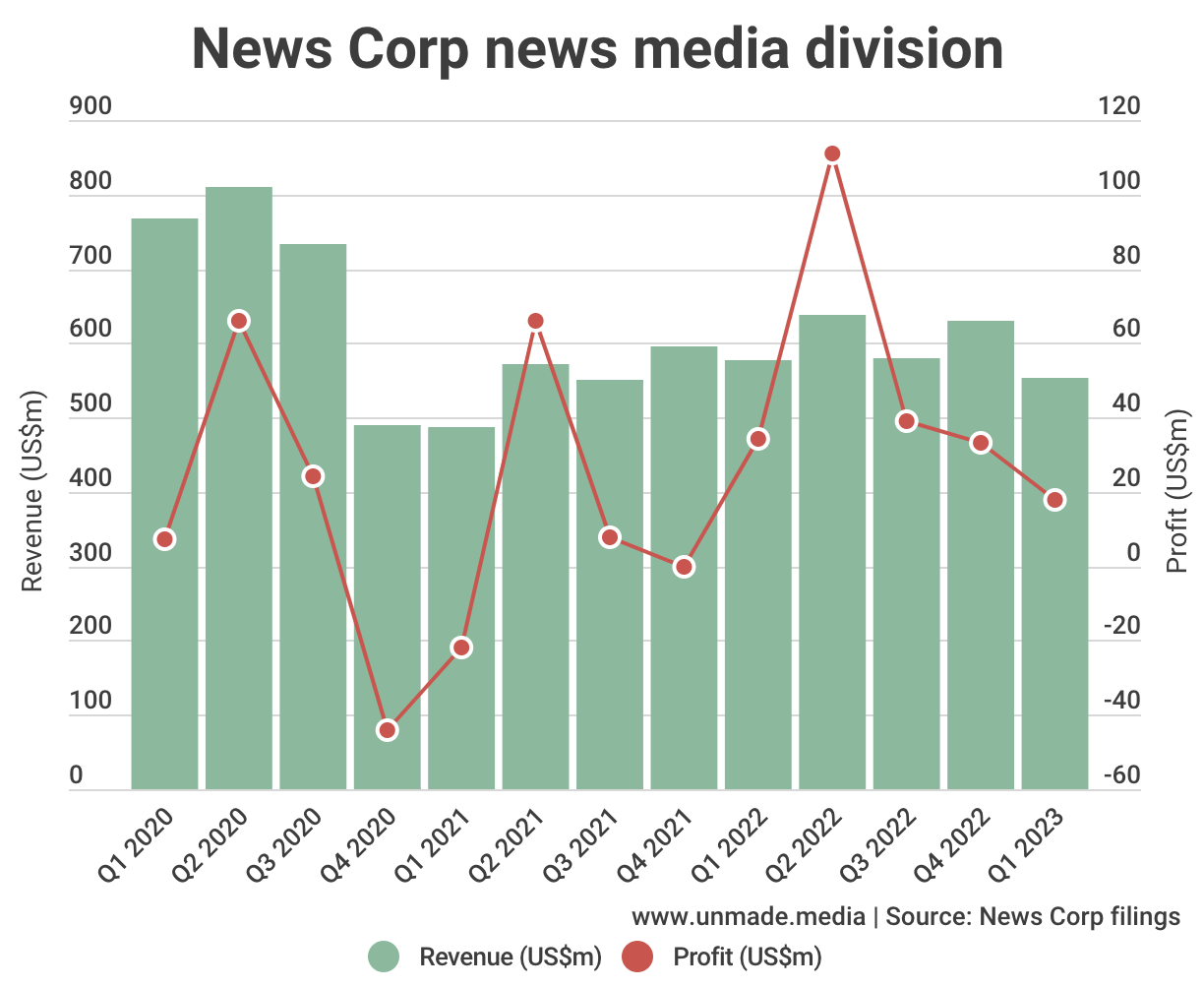

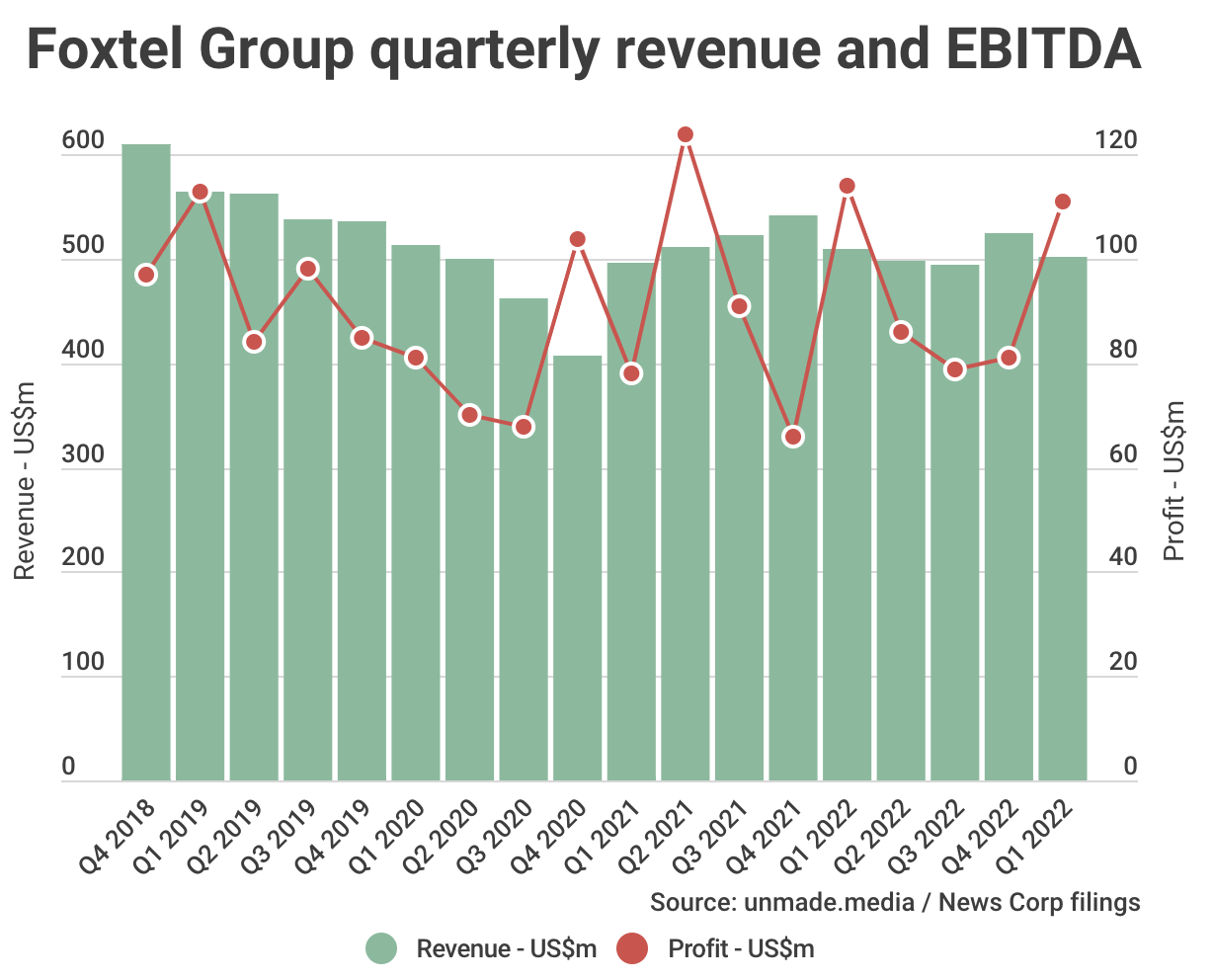

We are only in the fourth year of News Corp reporting results of its news division separately to its US Dow Jones data-led division. The green bars on the chart below show revenues, while the red line represent profits. My guess is that the Australian operation accounts for about a third of the news media division.

Thanks to closure of most of News Corp’s Australian community papers, the pre-pandemic revenues shown in the first three quarters on the above chart are not coming back. But the ongoing (for now) revenue extracted from Google and Facebook via the ACCC’s threat of the News Media Bargaining Code negotiations mostly maintained profits.

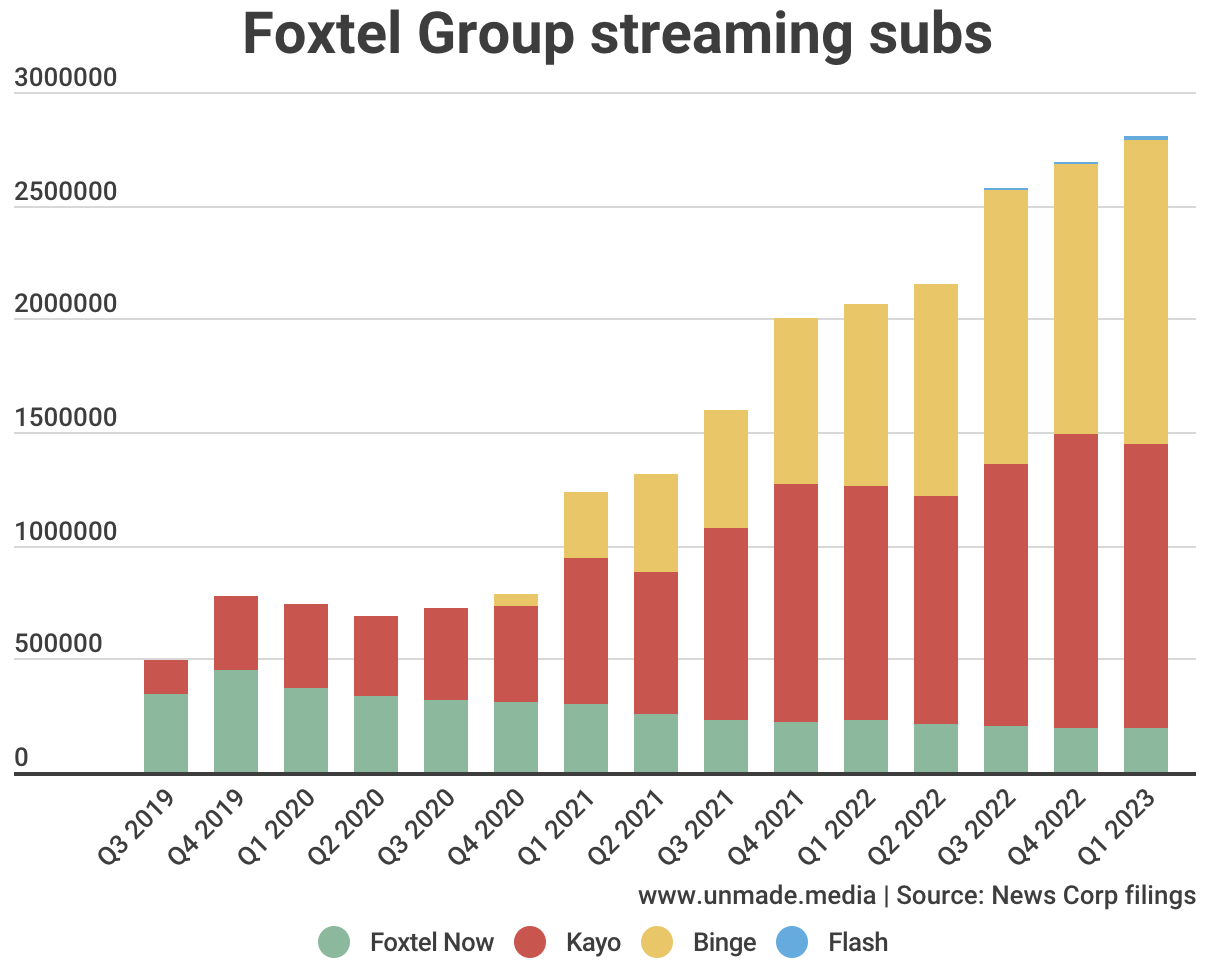

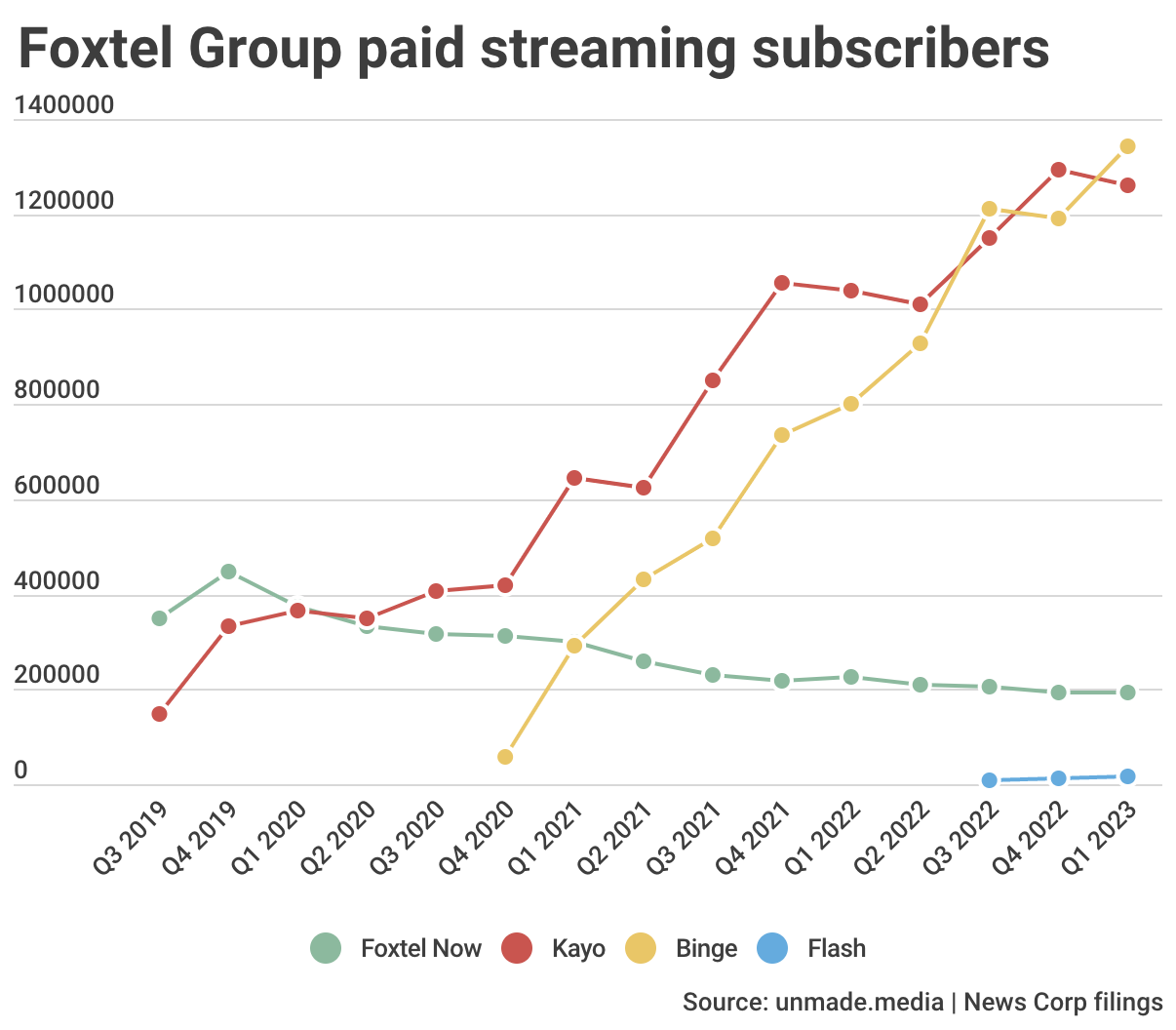

Just as interesting is the company’s streaming subscriber update. Foxtel Group has now grown its number of streaming subscribers for 11 successive quarters.

Within those numbers, Binge (1.342m subs) returned to growth, thanks to HBO’s House of the Dragon, while Kayo (1.259m) dipped, as it did in the same quarter last year.

That means that Binge is once again the company’s biggest streaming offering.

News service Flash is still struggling to find a customer base, reaching 15,000 subs in its third quarter. By contrast, Kayo was doing 364,000 subs in its third quarter after launch while Binge was on 431,000.

Even as Foxtel Group’s revenue flatlined, EBITDA profitability increased on the previous three quarters.

There was no update yesterday on the proposals to re-merge News Corp with Fox News owner Fox Corp. Fox Corp also announced its results this week, with profits for the quarter up fractionally to US1.1bn.

The merger remain s the main game.

Unmade Index –

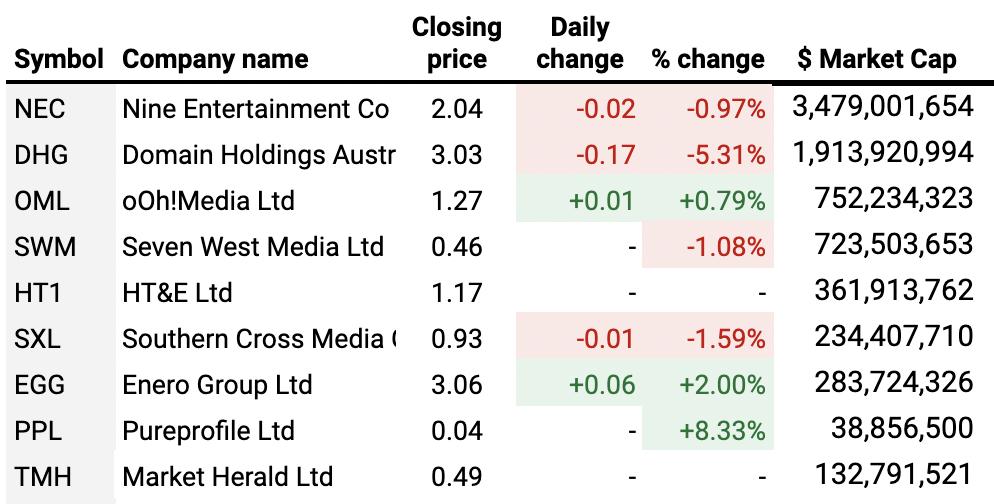

The Unmade Index made it five days of falls in a row yesterday, dropping by another 1.08% to 671.6 points.

Our index of locally listed media and marketing companies was dragged down by increasingly negative sentiment about the real estate market which took Domain down by 5.31% and in turn pulled majority owner Nine downwards with it.

Time to let you wrap up your day. I’ll be back with best of the Week on Saturday morning.

If you’re in Melbourne, I’d love to see you at next Tuesday evening’s Marketing in 2023 event. Don’t forget to book.

Have a great day.

Toodlepip…

Tim Burrowes

tim@unmade.media