Best of the Week: Sir Martin’s rocket ship suffers engine failure; Winners and losers of the quarter

Welcome to Unmade, written in snowy – yes snowy – England, while you were sleeping.

Happy National Play Outside Day. No thank you very much.

Today’s writing soundtrack: Arlo Parks – Collapsed in Sunbeams.

Note: Unmade’s paying subscribers receive our emails an hour before everyone else. It’s just one of the benefits of signing to Unmade’s paid tier and supporting independent journalism.

Sorrell’s problem with the accounts

When things change, they change fast.

Until recently, Sir Martin Sorrell’s S4 Capital was the fastest growing global communications holding company, including making inroads in Australia. This week its market capitalisation plummeted by a third.

In the space of three years, Sorrell turned $50m of his own money into a new giant with a market capitalisation of nearly $8bn.

It was the sort of trajectory that took him more than 30 years to achieve the first time round, when he built WPP. Celebrating his 77th birthday a few weeks ago, he’s been a man in a hurry to overtake the company from which he was ousted in 2018.

It had looked like Sorrell was well on course. If I’d invested in any global comms group, it would have been S4 Capital. Unburdened by the legacy of analogue agencies and media, it’s the only big communications group focusing solely on digital. That might not serve every client need, but it’s a great point of difference for potential shareholders. And Sorrell, although well into his eighth decade, remains an intimidating, hungry driving force.

An accountant by background, Sorrell has built his businesses through financial engineering as much as client service. The constant growth of WPP was powered by debt, and that was serviced through constantly growing the profits of the agencies he acquired.

It was a game of pass-the-parcel that he consistently won. Like all of the major holding groups, it wasn’t much fun being in charge of one of the WPP agencies (or working for one) when you were struggling to deliver the obligatory profit level. If one agency boss couldn’t deliver the number, then Sorrell could find somebody else, and this pragmatic ruthlessness flowed through the WPP hierarchy.

Through S4 Capital, Sorrell has used a different model to find growth – instead of doing it just through cash acquisition, he announced merger after merger in which agencies are subsumed within a single structure under the company’s main brand of Media Monks.

Unlike the established holding companies, Sorrell focused only on merging with those in the digital and data sphere. Full service agencies were out, creating a growth story that investors liked.

The word “merger” may give the wrong impression, by the way. In this case, it’s not the coming together of two equals, but a means of taking over businesses by issuing S4C stock to the agency owners.

The approach keeps the original agency owners on board and incentivised to ensure the company keeps growing. Usually this type of deal sees shares either issued later, or held in escrow, meaning they cannot be sold until a certain amount of time has passed.

It can make takeovers more affordable than all-cash deals. For instance, the owners of The Monkeys got a deal worth $63m when the agency was bought by Accenture in May 2017. Being a publicly listed company allowed Accenture to issue stock to the founders rather than cash.

The share price of Accenture has risen by 300% since then, so I hope they hung on to at least some of their shares.

But other agency founders who did stock based deals were less successful. The infamous Photon Group disaster was fuelled by deals based on an ever rising price on the ASX, alongside big earnout fees. When the GFC hit, the company ran out of road and those who had sold out only for stock effectively lost their agencies for nothing. Others that were owed earnouts – including BWM – got to buy back their agencies cheaply. Swings and roundabouts.

It took the best part of a decade for the company, now rebranded from Photon Group to Enero, to recover.

More recently, the Trimantium Growth Ops ASX float, which was again fuelled by share market shenanigans, was a disaster for investors. The agency owners in the deal, including AJF, didn’t fare quite as badly because they at least took some cash out of the deal when TGO floated.

Still, until now the model has worked for S4 Capital, which has grown to more than 7,500 staff in 33 countries. Nobody apart from Sorrell could have gone so far or so fast.

Which brings us on to this week’s crashing share price.

For a few weeks now there’ve been hints that something wasn’t quite right.

The company’s share price has fallen steadily over the last six months, although that may well have been down to short term sentiment around the company’s signal to the market six months ago that it intended to prioritise investing in business growth over short term profits.

But while all the other global holding company’s released their 2021 financial results over the last few weeks, S4C… didn’t.

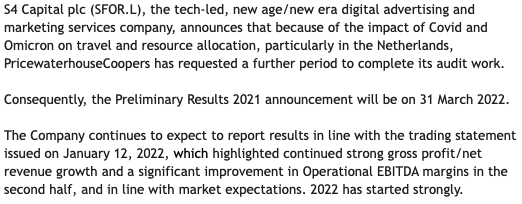

At the beginning of March it put out a short announcement saying that it was delaying its planned annual results announcement from March 18 to March 31 which would have been Thursday of this week.

The reason, it explained, was Covid delaying the work of the company’s auditor PWC.

But on Wednesday came a second, terse, update to the London Stock Exchange. The results announcement was being postponed again.

This time there was no new date for the release of the numbers. And Covid was no longer being blamed for PWC being unable (or unwilling?) to sign off on the audit.

This suggested that the problem, analysts at Morgan Stanley told the Financial Times, is “non trivial”.

The reaction of the market indicates that others think the same. Another unnamed analyst quoted by the FT described the company as being “eerily and worryingly silent” about the issue, whatever it might be. By the time the LSE closed for the week in the early hours of this morning, Australian time, there had been nothing more on the record.

Even without knowing the nature of the issue, the damage for S4 Capital is immense. There’s not just the auditing problem – whatever it might be – to solve.

The sizeable challenge going forward is that Sorrell’s model relies on the founders of his future target agencies being confident that if they take shares in S4 Capital that it’s as good as cash – or better. They need to believe that the share price will grow, or at the very least remain stable. That was easy when the price had only ever gone upwards.

It’s a confidence play. It’s all about belief in the force of nature that is Sir Martin Sorrell, and that it’s worth coming along for the ride while he builds another WPP.

But how could any agency owner do a stock based deal in the future while wondering if the value could fall by 30% in a week?

Even if the accounts are released in the next week or two with the issue dealt with, that damage has been done. Sorrell will need to find another strategy to continue the growth.

Alongside from the 2018 allegations of personal misconduct – denied by Sorrell – which surrounded his exit from WPP, this week’s events represent his greatest professional challenge.

S4 Capital had looked like a rocketship approaching escape velocity. Gravity is now threatening to pull it back to Earth.

Unmade Index: A quarter to forget

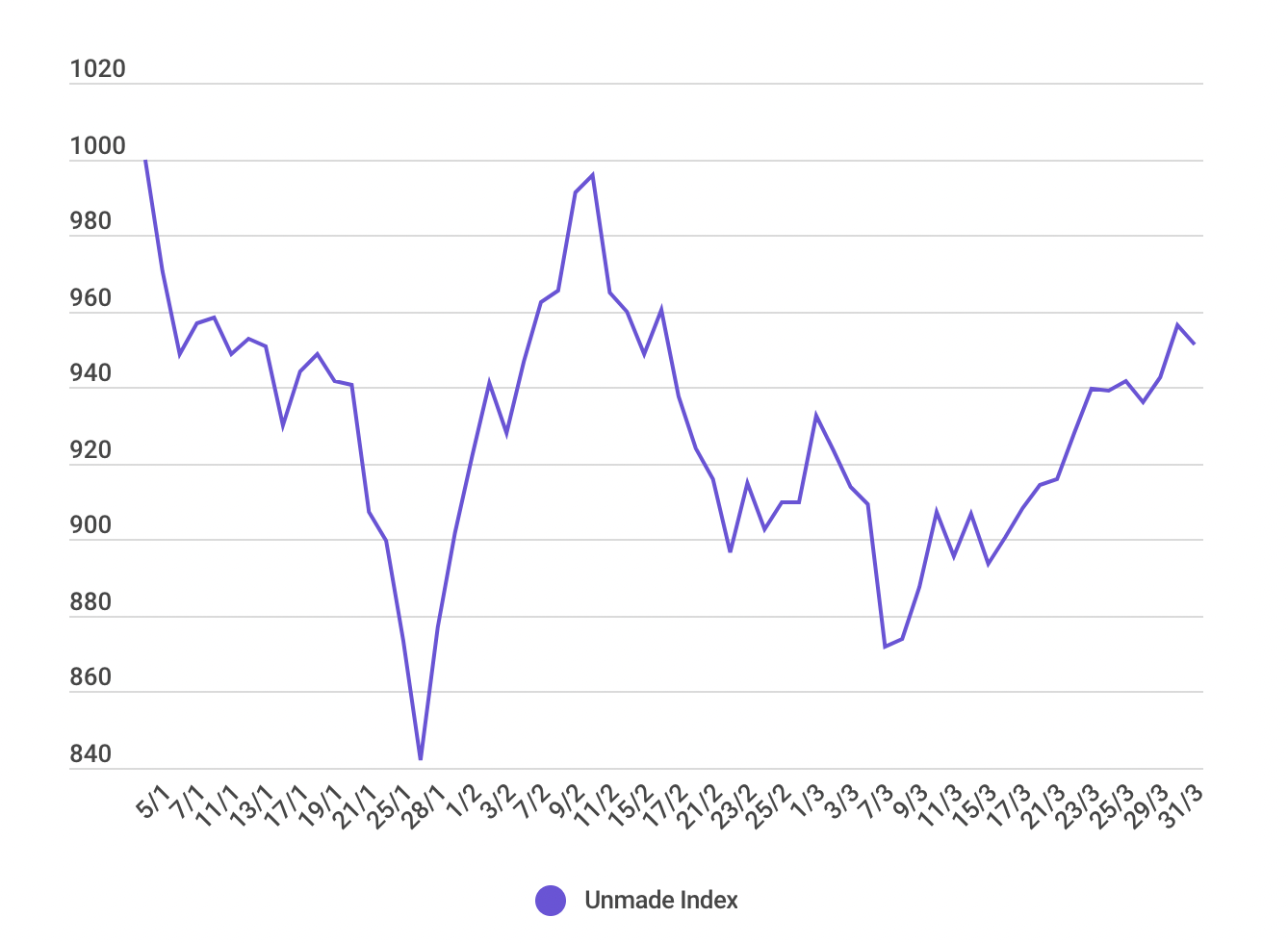

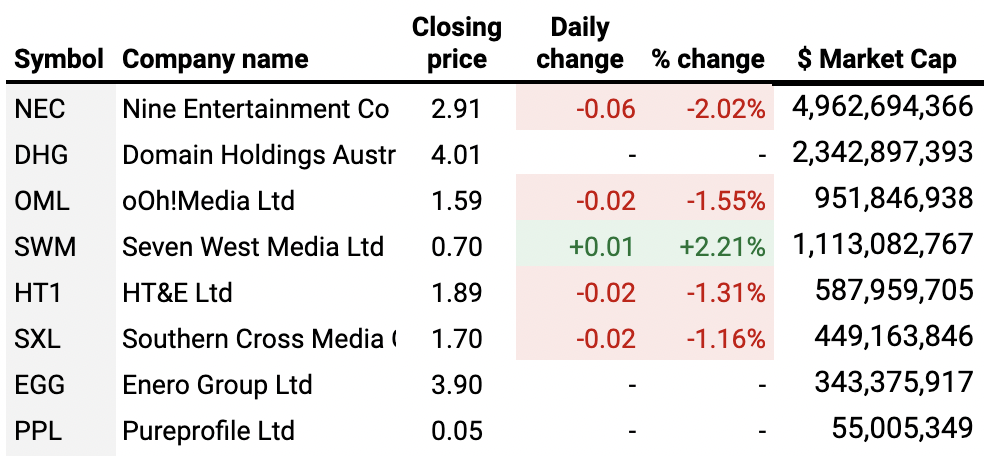

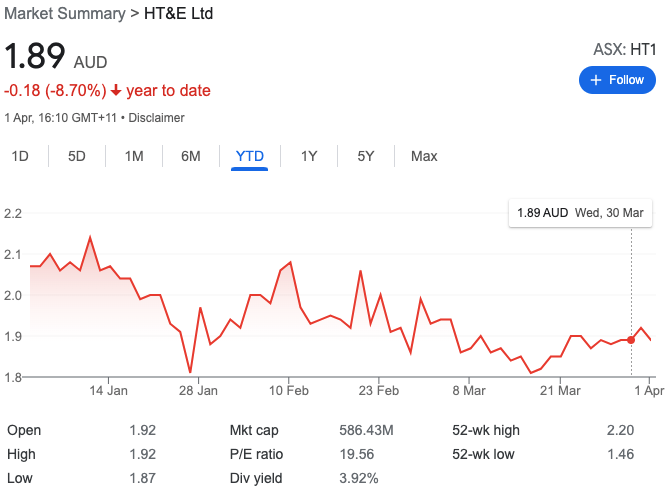

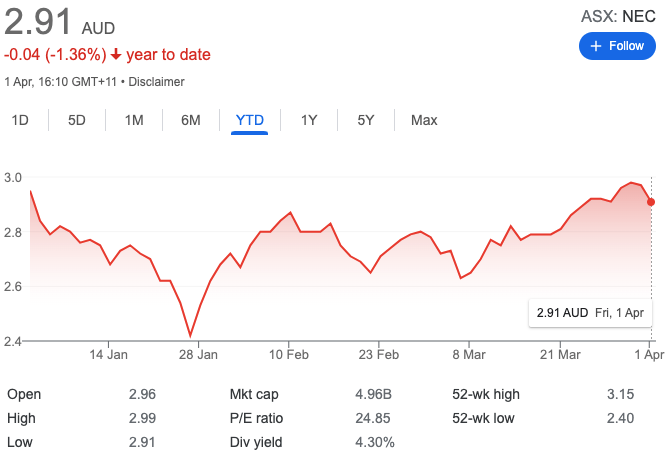

This week marked the completion of the first quarter of The Unmade Index – our tracker of the market performance of the ASX-listed media and marketing companies.

It wasn’t a great start. Opening on a nominal 1000 points at the beginning of January, at the close of the quarter on Thursday night, The Unmade Index was still more than 5% down for the quarter.

And admittedly that finish was an improvement on the low spot towards the end of January when the index was down by nearly 15%. Who’d be an investor?

And the market has continued to bounce around. Yesterday the new quarter opened with another bad day, with the index down by more than 1%.

Nine didn’t stay a $5bn company for long, with its market capitalisation falling back to $4.96bn. And Southern Cross Austereo fell back below half a billion dollars.

One quarter into 2022, it’s worth examining the performance of the companies.

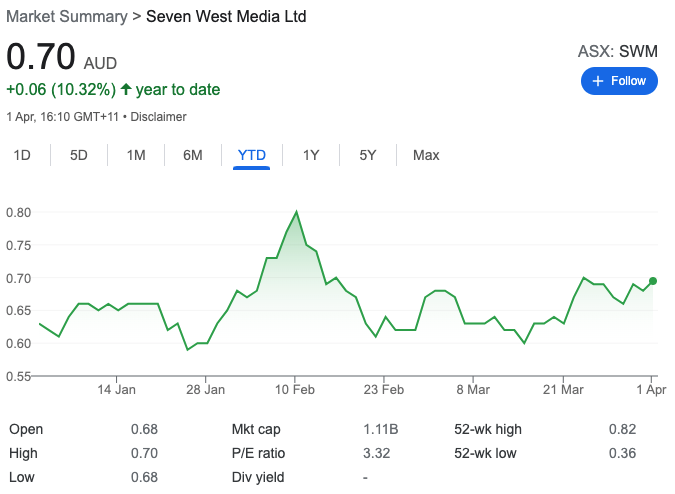

Only one ASX media company has actually grown its value for the quarter. That’s Seven West Media whose $1.1bn market cap has grown by 10% so far this year.

The market seems to be increasingly confident that CEO James Warburton is gradually getting a handle on the company’s debt pile.

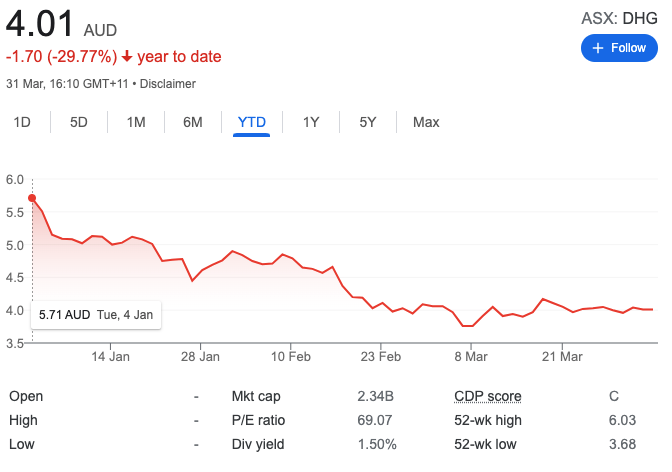

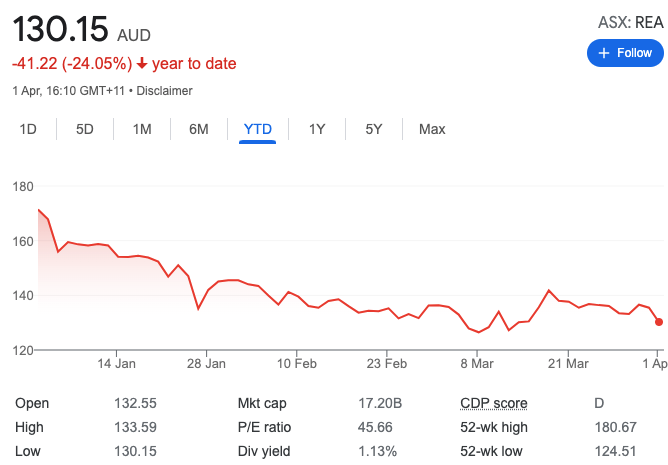

At the other end of the spectrum, the two organisations which have had the worst quarter are Australia’s two listed real estate companies – the Nine-aligned Domain and News Corp-aligned REA Group.

Domain is down by almost 30% for the year to date.

And REA Group, which we don’t include on The Unmade Index tracker because much of its business is offshore, is down by 24%.

Of the broadcasters, Southern Cross Austereo has had the worst quarter, with its market capitalisation falling by 12.4%. That’s despite the promises to the market of a sell off of the company’s TV stations and a share buyback.

Meanwhile, the relative minnow in ASX terms of research and data company Pureprofile is down by 10% for the year to date, with a market capitalisation of $64m.

The next biggest faller is HT&E, parent company of ARN, which owns the Kiis and Gold radio networks and this week rebranded The Edge as digital-first new music offering CADA.

With a few months to come likely mainly focused on bedding in the Grant Broadcasters regional acquisition, HT&E’s market cap is down by 8.7% for the year so far.

Also down for the quarter, as it waits for the out of home sector to recover, is Ooh Media, with a fall in market cap of 7.6% to $949m.

Holding company Enero, parent company of agencies including BMF, is down by 7% for the quarter and now has a market cap of $343m.

It’s worth noting that although News Corp is not included in The Unmade Index because of its global portfolio, the company is similarly down for the quarter, by 6%.

Meanwhile, Nine is in almost the same position it started the year, with shares down slightly, by 1.4% for the quarter.

During the first quarter, the media and marketing stocks tended to outswing the ASX All Ords. On down days they were even further off, and on up days, they outperformed the market.

The next quarter will, I’m certain, be defined by how consumers react to the cost of living crisis.

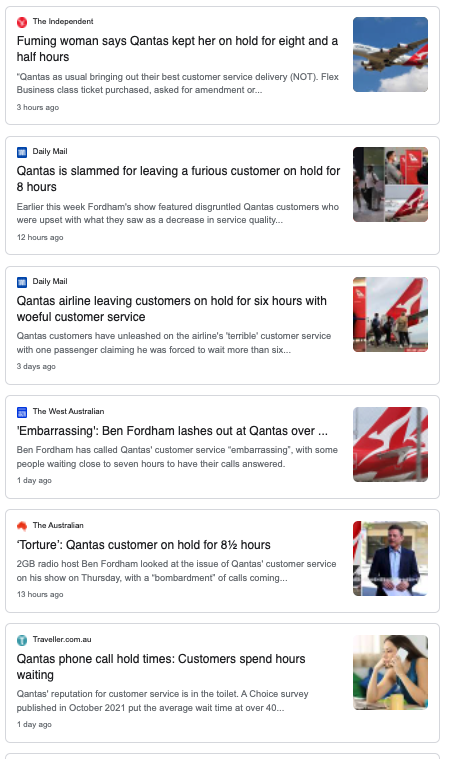

Qantas brand bomb explodes

Regular readers of Best of the Week may recall last Saturday’s prediction about Qantas…

My view was that having weathered Covid exceptionally well as a brand, Qantas risked blowing it unless it took control of its long call waiting times. The issue went mainstream in the days that followed. Yesterday the international news mastheads began to take an interest too – just when tourists are once again considering their travel options for Australia.

The problem for Qantas now is that once perceptions take hold, it’s harder to shift them. Even if it begins to get on top of the issue – and there’s not much sign of that yet – Qantas hold times will now be the airline’s biggest brand challenge for the rest of 2022.

In recent years Qantas has played a brilliant offensive game with its brand. Now we’re going to see how it does at defence.

Time to let you get on with your Saturday. Have a great weekend.

Toodlepip…

Tim Burrowes

Unmade

letters@unmade.media