Best of the Week: What the new data tells us about Foxtel

Welcome to Best of the Week, kicked off on QF2 an hour or two out from Darwin, in the early hours of Saturday morning, and wrapped up at the Ibis Darling Harbour early on Sunday morning.

Happy VE Day. I watched Christopher Nolan’s Dunkirk on the flight home to Australia. It’s underrated. The film’s power is in demonstrating the individual sacrifices of ordinary people to keep their home free. Seven decades later, it’s a bit too easy to take for granted.

Today’s writing soundtrack: Lemon Jelly – ‘64 – ‘95.

There was something peculiarly frustrating about boarding a flight on Friday morning Australian time, knowing the release of the News Corp quarterly financial numbers was due at any moment. Using the journey to look closely would have been a good way of using my time.

Despite knowing they’d probably arrive an hour too late, I had an illogical hunch that I’d somehow get them in the nick of time. And when the Qantas crew confessed that we’d be late departing because the (presumably not still not match fit) ground staff had forgotten to load headphones for the inflight entertainment, my hopes rose further. Incorrectly as it happens.

Which explains why today’s email didn’t arrive with you at its usual time on Saturday morning.

Still, I did enjoy writing at my hotel room desk during Darling Harbour’s 8.30pm fireworks display.

The Foxtel dilemma

In an alternative timeline the new set of News Corp numbers would have been critical to the market because they would have set the tone for an ASX listing of Foxtel before the end of this financial year. Instead, they contained the data which contributed to the decision to pull the plug, for now.

I reckon it was a close run thing.

In Foxtel Group, there was (and still is) a story of a dominant incumbent struggling to get to grips with a radically changing business landscape, but gradually getting there.

From the moment that Netflix and Stan launched in early 2015, the wind turned against Foxtel. From a disruptive, profitable force that always grew subscribers through innovation and aggressive investment in sports content, Foxtel began to look like the sleepy one.

The first attempts to join the battle were missteps.

The late decision to drop out of the Stan joint venture with Nine and to get in bed with Kerry Stokes’ Seven West Media for Presto was one. It had more to do with keeping strategic options open for future ownership deals between News Corp and SWM than they did launching a winning streaming service. And Presto was not a winning streaming service.

Similarly, the various streaming iterations of Foxtel Go, Foxtel Play and Foxtel Now made little sense to the outside world. But that needs to be weighed up against the business realities of milking Foxtel’s high value broadcast subscribers for as long as possible, even if that could not be publicly acknowledged.

Even now, the average monthly revenue per user from Foxtel’s broadcast customers is $82. Compared to a basic $10 Binge package, a single Foxtel broadcast subscriber is worth eight streaming customers. That’s slowly changing though as Foxtel Group gradually puts the streaming prices up. The basic Kayo package is going up to $27.50 from the end of this month.

The balancing act has been to – slowly – give the public what it wants in streaming to get a share of the new opportunity, while hanging on as long as possible to the broadcast subscribers.

Managing decline is a grind, yet it’s also the stuff of MBA textbooks. And Foxtel’s management team has done a pretty good job of grinding out profits since the days when the company was a cash-generating machine.

Tracking the fortunes of Foxtel is made more complicated because of its ownership structure, which has changed twice in the last decade. In a deal that was agreed ten years ago next month, News Corp bought out James Packer’s quarter stake in Foxtel and half share of Fox Sports. This left News Corp with half of Foxtel and all of Fox Sports.

And in April 2018, News Corp and Telstra merged Fox Sports into the Foxtel structure. This gave News Corp a two-thirds stake in the enlarged Foxtel, with Telstra owning the other third.

Which makes it more difficult to directly compare the performance of Foxtel in those different phases via News Corp’s quarterly updates on its video segment from before then.

It was only from the fourth quarter of the 2018 financial year, that we can begin to make like-for-like comparisons .

And inconveniently, the pandemic pandemic confuses things even further.

Still, let’s have a go.

Most relevant is the switch to streaming. The price point is lower and the customer is more fickle as they get used to turning subscriptions on and off on a monthly basis. But the customer base is potentially larger, albeit with the competition of multiple services.

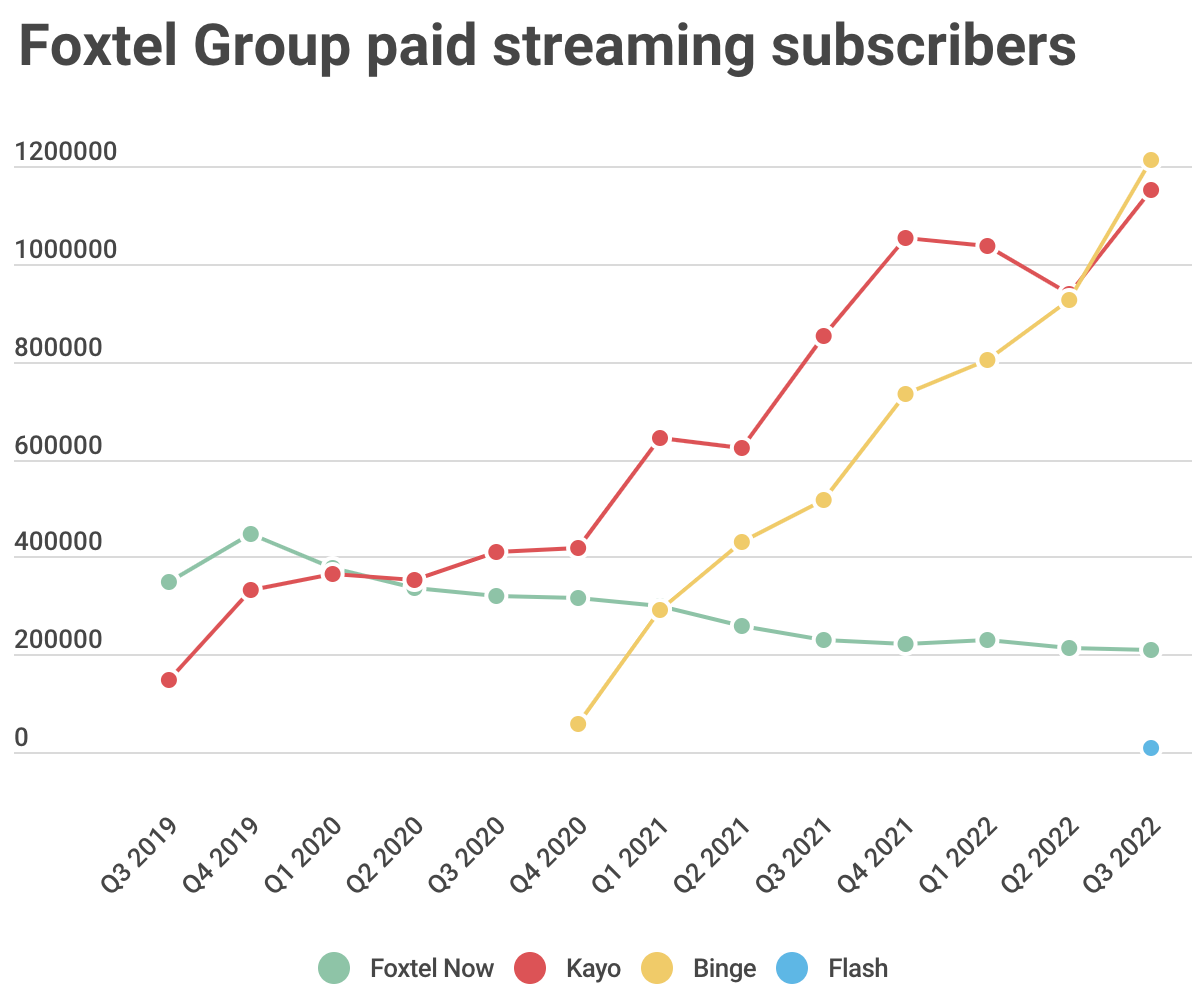

So how has Foxtel Group done at streaming? I’ve built a graph showing the trajectory of the number of paid customers for each of its streaming platforms.

I built the graph by looking at each News Corp quarterly financial update since the third quarter of the 2019 financial year.

Let’s take it service-by-service.

Foxtel Now

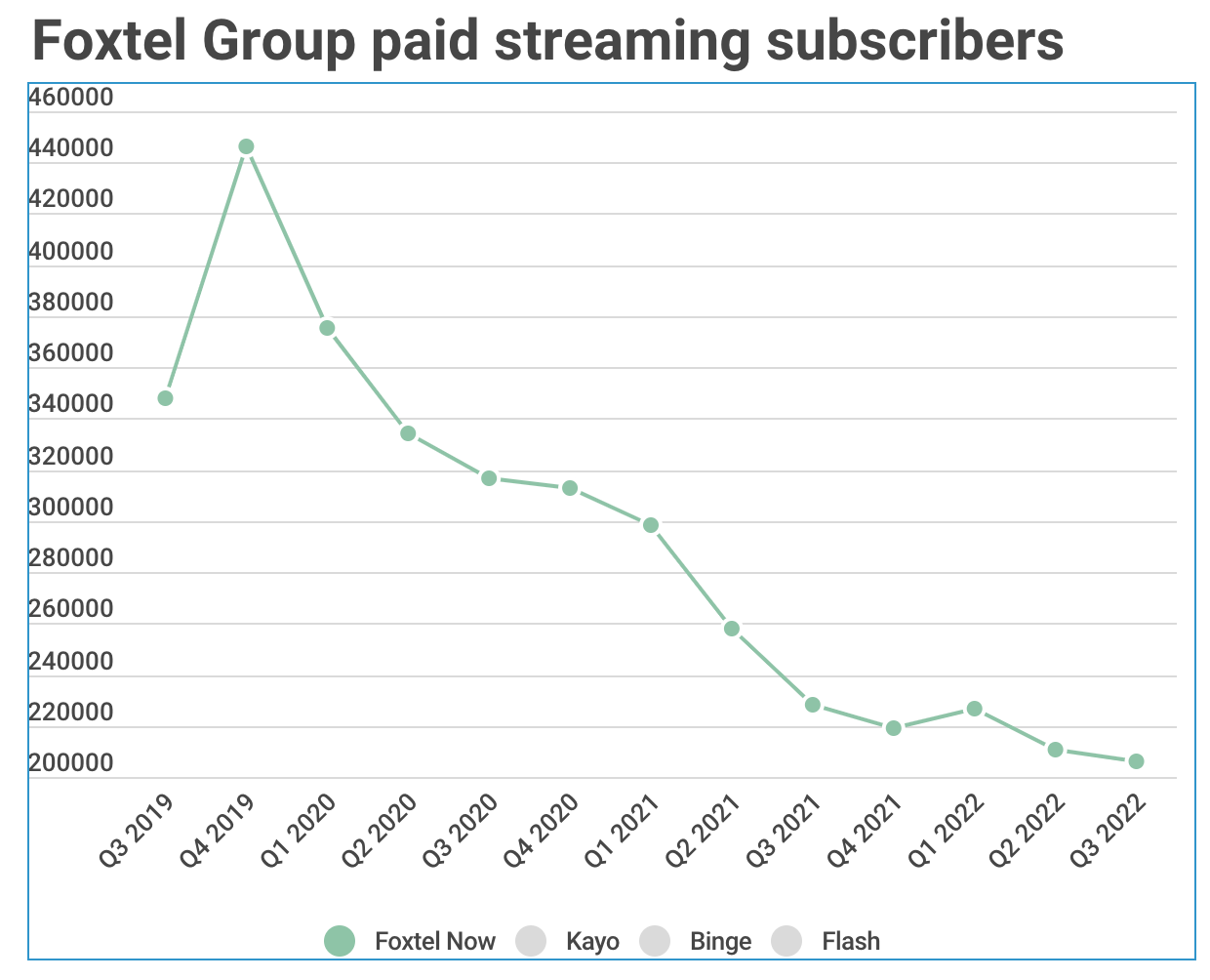

First come the paying Foxtel Now subscribers. By the fourth quarter of FY19, there were 446,000 of them. That high point coincided with the final season of Game of Thrones which was the crown jewels of the company’s output deal with HBO. It marked the first time in Australia that GoT fans had a way to legally stream the show without buying a Foxtel broadcast package.

Compared to other offerings in the market, including the group’s own Kayo sports service and Binge, there’s little pricing rationale for customers to stick with Foxtel Now. It says a lot about inertia and the power of the Foxtel brand that so many have.

Foxtel Now numbers are half what they were four years ago, but I suspect this is planned decline while the cow is milked for as long as possible. Considering the Foxtel Now streaming package can cost as much as $84 a month, what’s impressive from a business perspective is that even in the last quarter there were still 206,000 customers.

Kayo

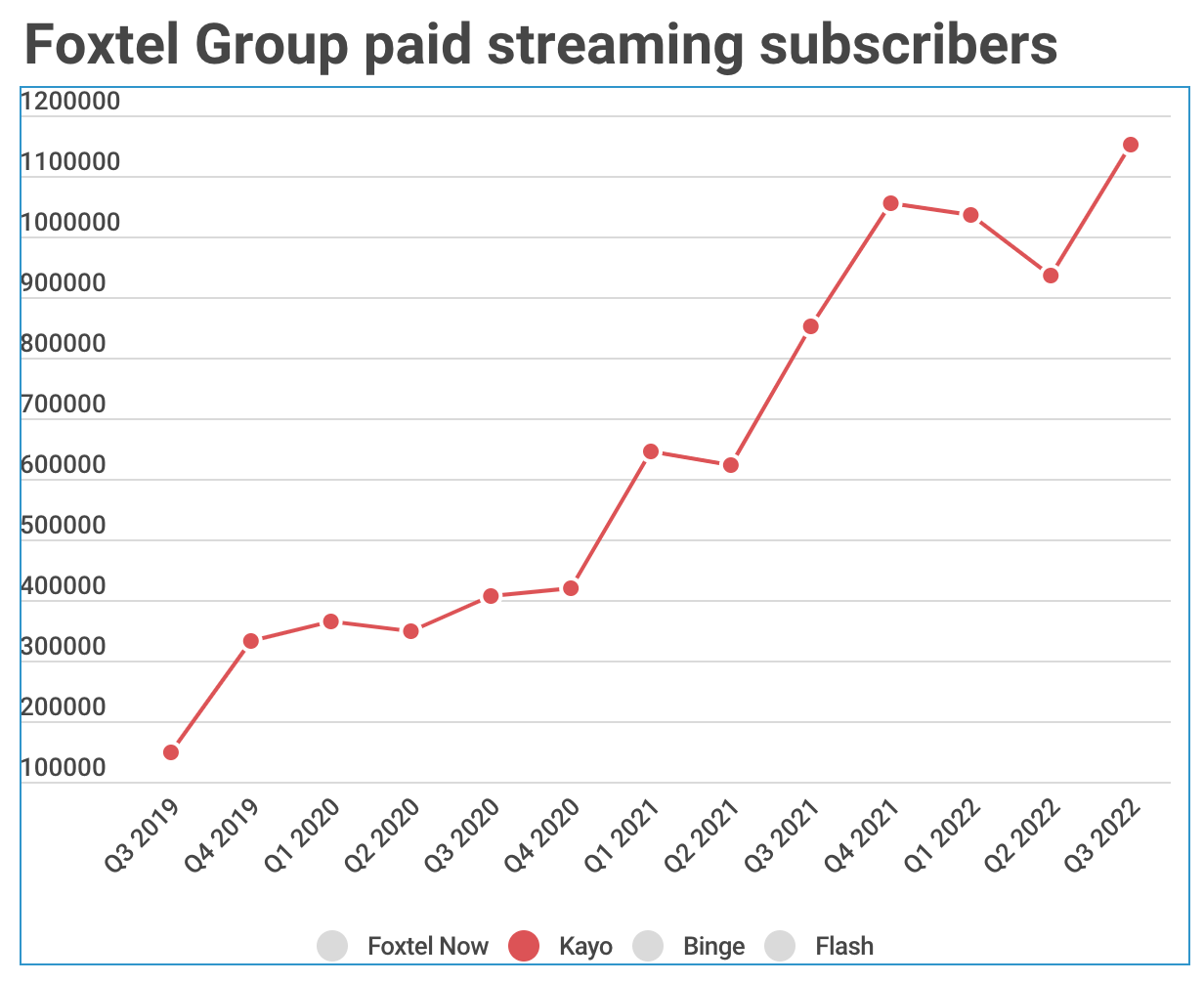

Next comes the rise of Kayo.

First, I should disclose that there is one shaky data point on my graph. I’ve had to guess the Kayo number for Q2 2022. All I know for sure is that it’s somewhere below 1m. Three months ago, News Corp did not share that number in its update. It dropped the usual practice of sharing both total and paying customers (there are always some people doing a free trial at any given moment). Instead, it merely said there were more than a million “total and paid” subscribers.

My suspicion is that they did not want to admit to the market that Kayo’s paid number had fallen, just as it was looking to list the company based on a story of subscriber growth.

This quarter they resumed sharing both numbers, which included 63,000 non-paying customers for Kayo. So I’ve applied that number to the last quarter as well.

Although its obscured by the period of the pandemic, it looks like a lot of Kayo customers pause their subscriptions when their favourite sport is on a break. That means more customers during the AFL and NRL seasons, and fewer in the summer.

But without the most recent data point of resumed growth (up to 1.151m paying customers), the Kayo graph would have looked worrying to potential investors.

Binge

The growth of Binge to 1.212m customers over the last two years is also a strong story. The question will be of what happens to those numbers when the HBO deal ends in a few months?

Which leaves just one more streaming service…

Flash

If you go back to the first graph, you’ll see a small dot in the bottom right hand corner.

Foxtel did not specifically share its numbers for its new streaming service, Flash, on Friday. But by subtracting all the other numbers from the company’s paying subscriber totals, the remaining number is 7,000.

Flash launched midway through the second quarter. So this number is a reflection of where it got to after four-and-a-half months. At $8 a month, that amounts to revenue of less than $1m a year.

From the start, Flash felt like a niche product, with a more limited market. Its failure to find an audience is no commercial disaster. Most of the technology investment had been made.

Rationally, you’d expect Flash to be killed off quickly from here. There’s no shame in experimenting. However, given News Corp’s love of the news game, it will be interesting to see if it sticks with Flash a little longer.

The finances

All this plays out against a financial backdrop.

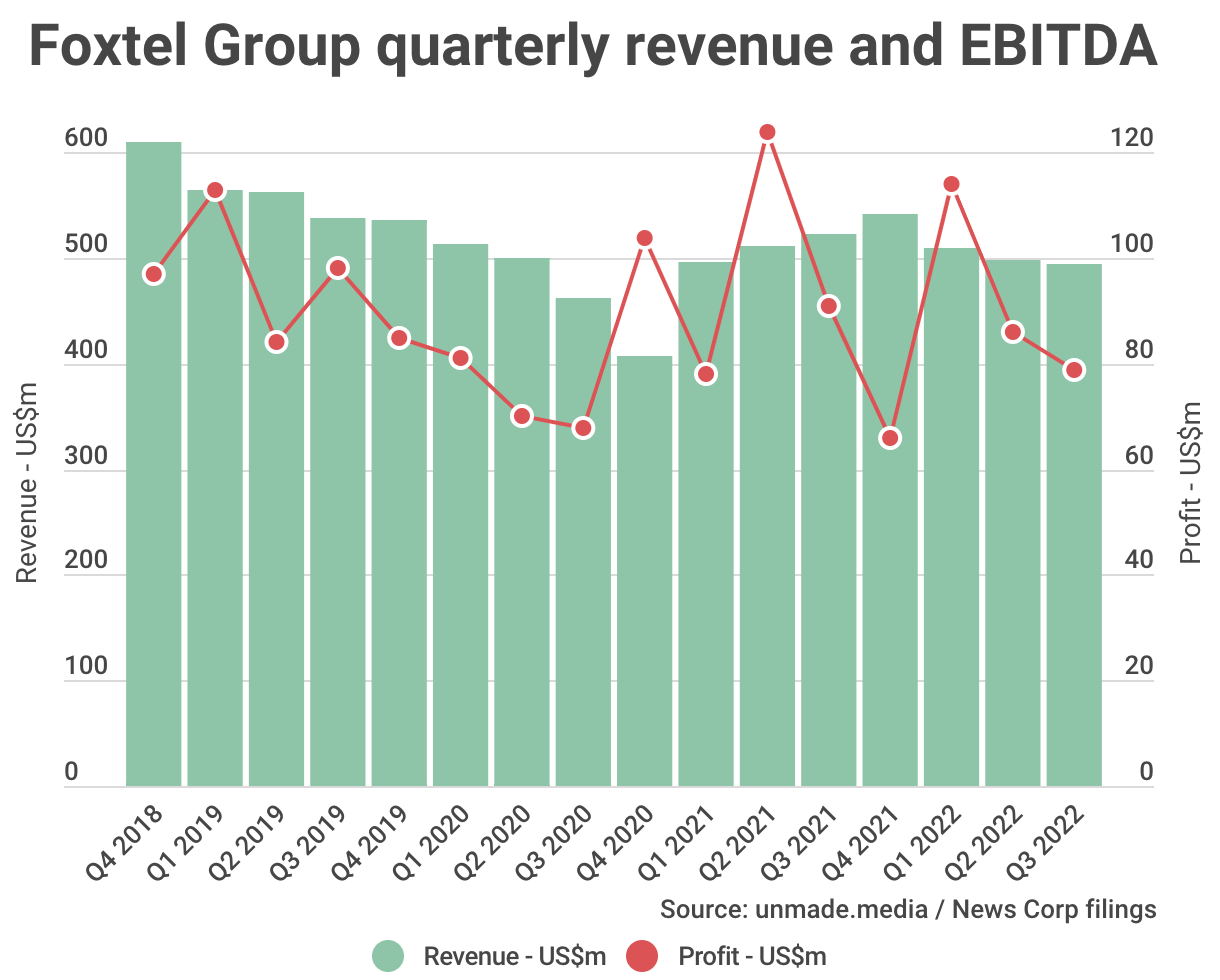

News Corp shares its quarterly EBITDA (earnings before interest, taxation, depreciation and amortisation) numbers for each segment, including video.

Although this is not the whole picture, because some costs get shifted across the group, it would have been a key one for the potential float.

The graph below shows revenue as a bar chart and EBITDA profit as a line.

Over the last four years, revenues have fallen from $US610m for Q418, to $494m in the last quarter – which is a drop of nearly 20% in less than four years.

Mainly that’s because of losing Foxtel broadcast revenue faster than streaming revenue comes in. But another factor is that the company reports in $US which makes things look worse as the Aussie dollar weakens.

You can see Q420 (April, May and June 2020) as the moment when revenues hit an all time low. That of course was the early months of the pandemic when customers stopped spending, advertisers stopped investing and sport went off the air.

One fascinating quirk of the graph, was that this rough period actually saw profits jump up. We can put that down to a temporary reduction in fees paid for sports rights and Job Keeper.

More concerning is the profitability trend for the group, which has fallen for the last two quarters, down to $79m in the last quarter.

In Friday’s investor call, News Corp signalled that it expects its overall profits to fall further as it invents in content which is getting more expensive.

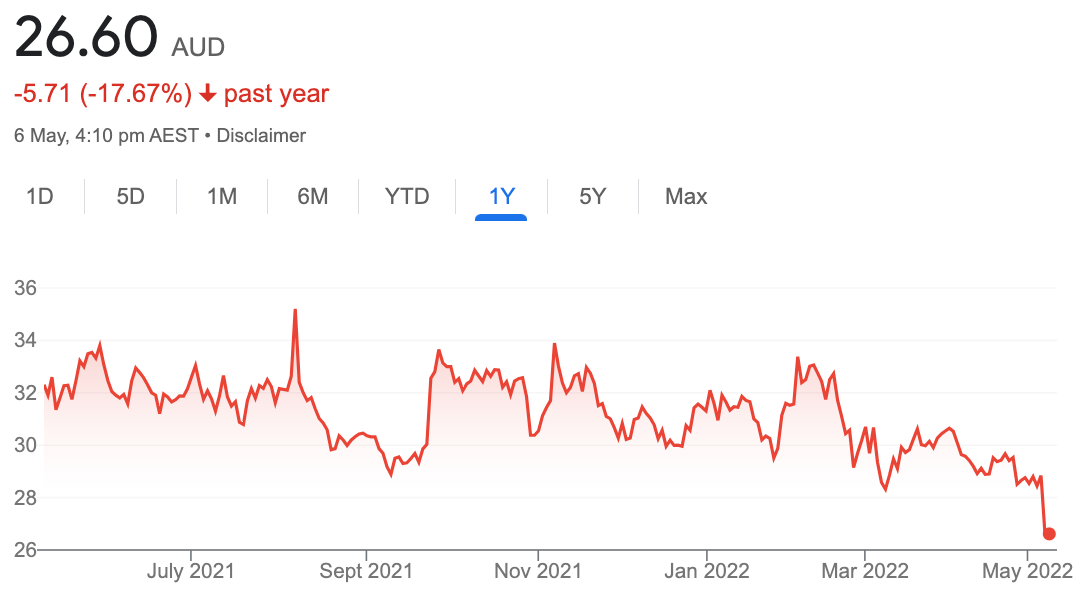

Combined with a softening in the real estate outlook, it contributed to a bad day on the share market, with News Corp shares falling about 8%. They’re currently at a low point for the last 12 months.

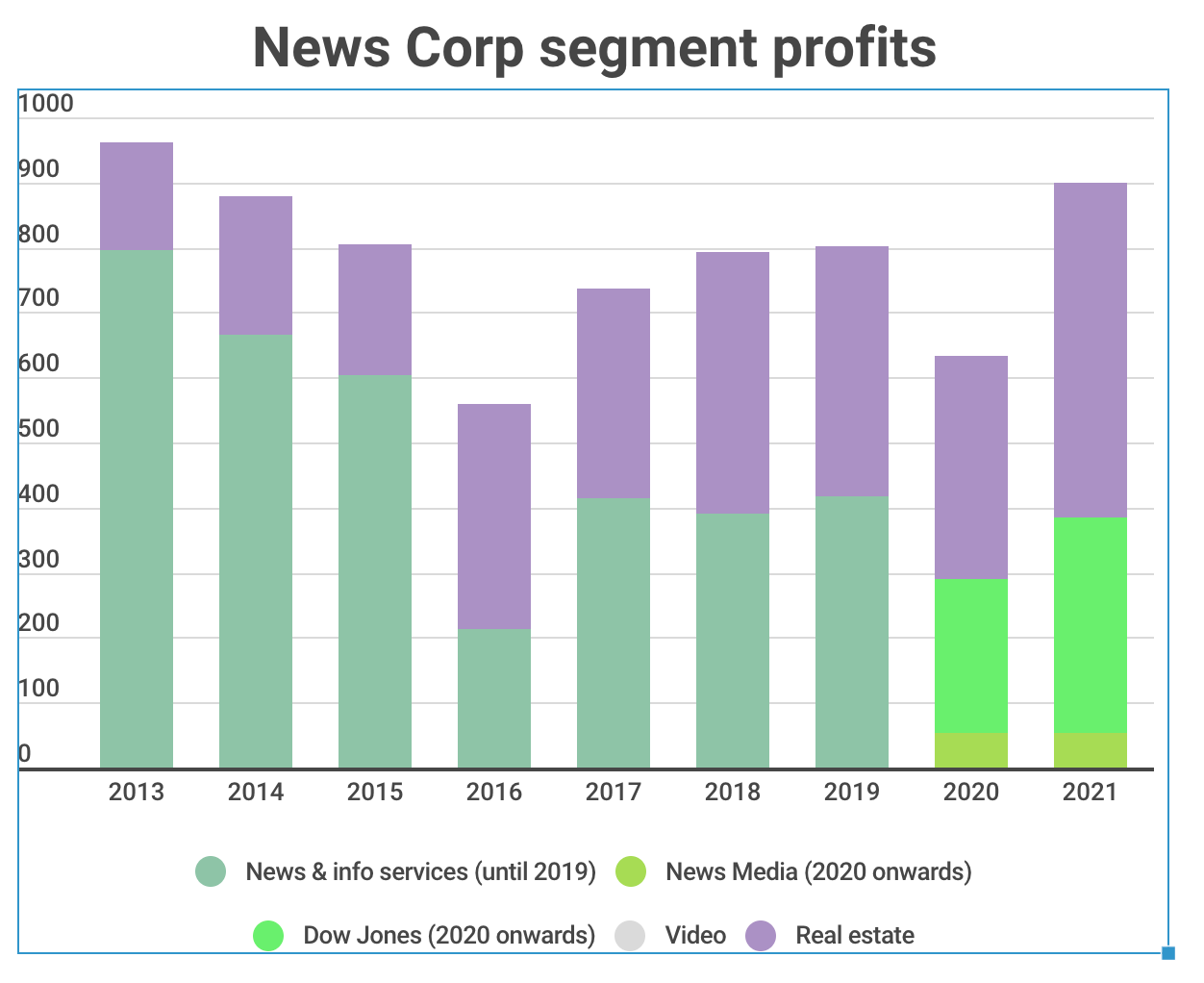

Speaking of real estate, I’ve created just one more graph. We may think of News Corp as a news company, but one of its most important profit centres now is the digital real estate market, including REA Group here in Australia.

Back in 2013, the company’s news & information segment was a far more important source of profits than real estate, contributing an annual US$795m compared to $168m.

The news & information segment was split into two for reporting purposes from 2020 onwards – news media and Dow Jones (the Wall Street Journal).

Even with the Facebook and Google money kicking in, news media contributed just $52m in profit in the 2021 financial year. Real estate contributed ten times as much at $514m.

The company could do without a real estate slowdown.

So what next? A Foxtel float is off the table for now. We may be in the beginning of a stock market slump. Stock market sentiment has turned against streaming investment anyway. Potential investors would want to see what happens next with not just the HBO deal but sports rights. AFL will be expensive to retain in the fact of a challenge from Ten’s parent company Paramount.

And in the meantime Foxtel owes around $2bn, which will become more expensive to refinance as interest rates rise.

Nonetheless, it’s a good, well run company. Foxtel management’s best option now looks like getting their heads down, to keep cutting costs and trade their way through.

Bad day on The Unmade Index

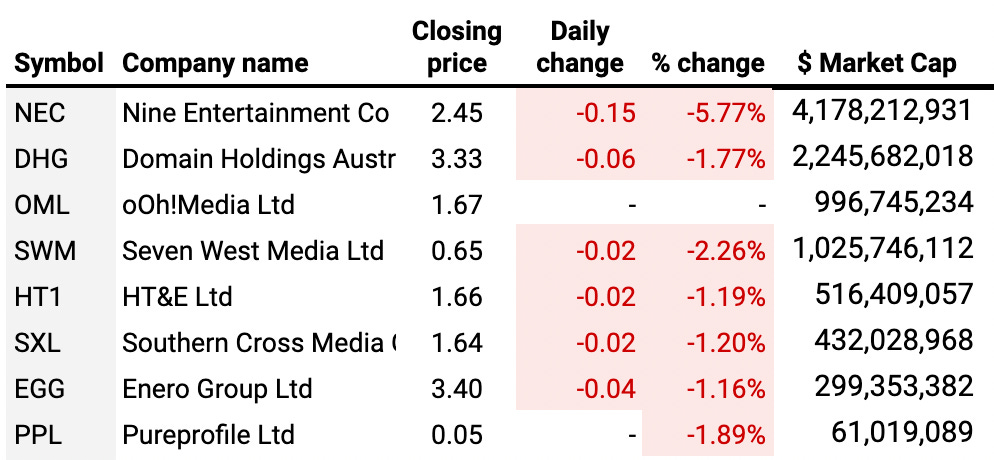

Friday’s global stockmarket rout was reflected in the worst day since we started The Unmade Index of listed media andd marketing companies at the beginning of the year.

The day’s fall of nearly 3.6% was the biggest one day drop we’ve seen, while the index is now 16% off its 1000-point opening at the start of the year.

Nine had the worst day of it on Friday, with its shareholders seeing about a quarter of a billion dollars wiped off its valuation. Seven West Media slumped by nearly 2.3%.

With local interest rates set to rise further, it’s hard to see where Australian media and marketing stocks will find upwards momentum in the short term. The coming week’s ASX performance will be fascinating.

Time for me to get moving. I’ve got to check out of this hotel. For the rest of this week, I’m staying across town. (Somehow I messed up my international datelines and had to make a last moment booking when I belatedly realised in the departure lounge that I had nowhere to stay on Saturday night.)

I’ll be back tomorrow with my colleague Damian Francis form Unmade’s Start The Week podcast.

And finally, a reminder: Don’t forget to join us at our first event – Marketing in a Cost Of Living Crisis. It’s in just over a fortnight. We’re running it at the Forresters in Surry Hills on May 24. We’ve got a great lineup. See all the details via this link.

Enjoy what remains of the weekend.

Toodlepip…

Tim Burrowes

Unmade

letters@unmade.media