BOTW: After missing out on AFL and cricket, what now for Ten?

Welcome to the first Best of the Week of 2023, written on a beautiful summer’s day at Sisters Beach, Tasmania after a restful overseas break during which books were read, card games were played and Happy Hour was fully utilised.

We’re coming back slowly. The news cycle is still quiet, so we won’t be bombarding your inbox unnecessarily.

Happy National Dress Up As Your Pet Day. If only Dominic Perrottet had gone with that. Today’s writing soundtrack: This Is The Sea – The Waterboys.

Where does Ten go from here?

The most intense cycle of sports rights renewals that the Australian TV industry has seen is coming to a close. For the most part, it’s status quo.

A year back, Nine extended its NRL deal through until 2027, without the process going to a full auction.

In September, Seven and Foxtel saw off Paramount’s attempt to take the AFL rights, locking in a new deal through to 2031.

In November, Nine renewed the tennis through to 2029.

And early in the New Year, Seven and Foxtel Group renewed their cricket deal through until 2031. Although Ten’s owner Paramount had been in the mix, in the end it didn’t put in a binding bid.

Among the major sports rights, just one is changing hands – the Olympics. The news passed many people by, because it dropped on Christmas Eve when everyone was busy trimming their metaphorical yule logs. The Sydney Morning Herald reported that incumbent Seven has been outbid by Nine in a deal that runs through until Brisbane 2032. Maybe the official announcement will come during the Australian Open.

That all leaves three of the four big TV players happy enough.

Seven arguably came out furthest ahead, paying less than previously for cricket and with more digital rights to AFL.

Both of Seven’s free to air deals were effectively subsidised by subscription partner Foxtel Group. Foxtel probably overpaid, but has at least won itself time for the window to reopen on an IPO, powered by continued growth for Kayo.

Nine delivered drama-free renewals with NRL and tennis. We’ll have to wait for the detail of its Olympics deal on how that will sit across both free to air and behind the Stan paywall. But again, the company is able to build long term plans for both platforms

Which brings us to Ten, these days owned by Paramount.

Since then-proprietor Lachlan Murdoch’s decision to let Ten’s AFL rights go in 2011 – in the misguided belief he could win NRL the following year – Ten has lacked a top tier winter sport. From 2013 to 2018, Ten’s summer schedule was underpinned by the short form Big Bash League cricket, which then went to Seven. For the last five years, Ten has been without a major winter or summer sport.

Although they’re expensive, the major sports are crucial to networks. They offer long term ratings certainty to advertisers and sponsors, which in turn means long term deals. And they offer platforms from which to launch new shows. It’s hard to find momentum without sport in the schedule.

Given the buzz of the franchise in other markets, it’s entirely possible that The Traitors could have avoided flopping at the end of last year with a stronger launch platform.

That search for momentum is why Paramount went hard for AFL in particular, and must have been so disappointed not to get it.

From the outside, it’s tempting to conclude that the incumbency barrier is impossible to beat. One perception within the industry is that Ten’s struggle to find ratings for A-League soccer hurt its case that code administrators could rely on it to deliver audiences.

Another perception is that it’s too dangerous not to cut Foxtel in. Shareholder News Corp’s thermonuclear reaction to NRL boss Dave Smith locking it out of a deal with Nine back in 2015 is still legendary. Smith was soon gone from the job, and Foxtel eventually got its deal.

In the end though, AFL simply went with the biggest bidder. Paramount got close. Close enough that at one stage the AFL was drafting an announcement with Paramount’s name on it rather than Foxtel and Seven.

There’s a danger of drawing too many conclusions about a knife edge outcome that went the wrong way. In a parallel timeline the Paramount team could have done exactly the same things and won. They may not have actually made any mistakes. That’s TV – you can play well and still lose.

Nonetheless it was a moment which will define the patterns of free to air TV for most of the rest of this decade.

Ten seems doomed to remain in third. But not doomed.

The deals emphasise that each of the three free to air TV broadcasters is now playing a different game.

Nine is a multi-platform local media company. As well as having streaming and free-to-air components in Stan and Nine network, it also owns publishing and broadcast businesses. It bids accordingly.

Although Seven has the strategic weakness of not owning a subscription platform, it also has the strategic strength of not owning a subscription platform. In the end it was the only available bidding partner for Foxtel. Thanks to the anti-siphoning rules, Foxtel needed Seven, and ended up effectively subsidising the bid.

However, where that potentially leaves Seven vulnerable will be as sports viewing evolves away from broadcast free to air. Holding multi-platform rights becomes increasingly important. That’s why Ten declined to bid on the cricket when it wasn’t able to make an all-rights offer.

The priority of Paramount globally is TV. It has been attempting to sell its book publishing arm Simon & Schuster, and has been buying TV assets around the world.

Although there’s been speculation in the media that Paramount might be a seller of Ten, that doesn’t stack up against its global strategy. The parent company of the CBS network in the US, it also owns Channel 5 in the UK, along with operations in Argentina and Chile.

Owning a free to air network is a powerful way of promoting Paramount Plus subscriptions. Along with the forthcoming FAST (free ad-supported streaming TV) channels under the Pluto TV banner, the free to air component is part of a wider commissioning strategy.

Ten is a direct source of revenue to Paramount via its content deals. Paramount ended up as the network’s owner thanks to the studio output deal which saw CBS Corporation (as it was then) the biggest creditor when Ten went into administration in 2017.

Commissioning shows from the Paramount stable is also cheaper for Ten. The Real Loveboat and The Challenge may have been dogs, but they were cheap dogs.

Ten is likely still profitable in its own right. Even distant third can be lucrative. The last sent of company accounts were filed with ASIC back in August 2021. They showed a statutory loss for 2020 of $3.4m, but an EBITDA profit of $54m.

Ten’s 2021 accounts will be filed soon. The company cut its costs during the last couple of years, so even with a ratings squeeze by the other two networks it’s likely to have maintained its profit levels.

The media agencies will go on supporting the network, sometimes disproportionately compared to ratings. They need to keep it in the game to keep Seven and Nine honest.

However, the excitement of TV will be distinctly lacking for Ten in 2023. Sport was the big strategic lever to pull. Expect second and third tier deals at best.

Comparative to Nine and Seven, Ten has under-invested in news. Yet alongside sport, that’s what builds audience habits over decades. It will be interesting to see whether any of that investment that was earmarked for sport will go back into news instead.

Being third may not be much fun. But it’s still a business.

Campaign of the Week: Dear Harry and Meghan

In an experiment over the next few editions (which may become permanent if readers find it useful), we’re teaming up with our friends at Little Black Book Online to highlight the most interesting marketing campaign of the week.

LBB Australia MD Toby Hemming writes:

“In a sharp change to high budget TV ads and award nudging corporate campaigns, this simple tactical execution from Thinkerbell on behalf of Koala is our campaign of the week.

A brilliant mix of timely creativity, PR and media it goes to show the power of quick smart thinking to create an impact. And the opportunities that can exist when an agency really thinks about mixing disciplines.”

Read more at LBB Online.

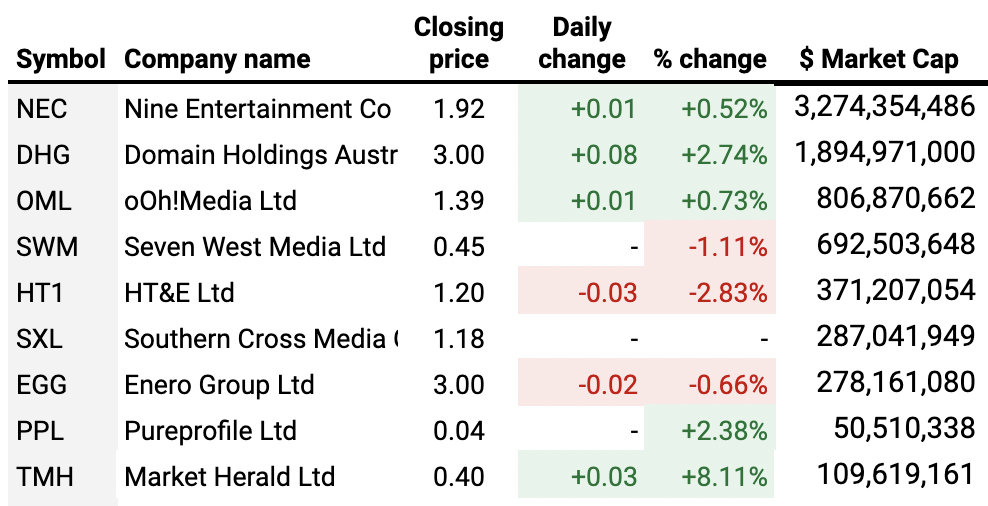

Unmade Index: A slow upward crawl

The Unmade Index finished Friday much the same way it progressed the whole week, with a mild rise of 0.62%.

The Market Herald price continued to gyrate on relatively low trading volumes, rising by 8.1%, taking it to a market cap of just under $110m.

HT&E, parent company of ARN, fell by 2.83%, taking it down to a valuation of just under $290m.

Overall, the index is now up about 7.5% on is 611-point opening for the start of the year

That’s where we leave you for today.

We’ll be back during the week with some exciting news about who we’ve signed up to speak at Re:made – Retail Media Unmade.

Have a great weelend.

Toodlepip…

Tim Burrowes

Publisher – Unmade

tim@unmade.media