BOTW: The economics of podcasting and a fork in the bird

Welcome to Best of the Week, mostly written on a sunny Friday at Sisters Beach, Tasmania.

Happy International Men’s Day, except to performative jetskiers.

Today’s writing soundtrack: Caroline Shaw – Partita for 8 Voices. I needed something calming and classical after an unusually eventful second half of the week. Oh, boy. The next reader update on Unmade’s progress is going to be a doozy.

Today: Podcast boasting rights; Twitter (yes, again) and more red on the Unmade Index.

If you’d like to support independent journalism by becoming a paying member, then I’ll be grateful. But I’ll be doing some sort of discount when I publish that next update, so feel free to wait a few days if you like.

The emerging economy behind Australia’s podcasting boom

If you’re looking for evidence that the podcasting space is maturing, a great place to start is with the audience metrics.

Suddenly there are multiple ranked battlegrounds: top publisher, top sales house, most podcast listeners, most downloads.

And just like everybody can claim to be a winner at some demographic in television, the same now goes for the audio game.

The newsest addition to The Australian Podcast Ranker is the battleground of sales representation. This calculation began to appear on the ranker four months ago.

It comes as the audio players seek to grow their podcast networks to a critical mass.

In recent weeks, Listnr added local representation of Amazon’s Wondery podcast studio, along with Stitcher and SiriusXM (home of podcasting juggernauts like Conan O’Brien Needs A Friend and Freakonomics Radio. Listnr also reps Schwartz Media and NBC Universal now.

Meanwhile, ARN also looks after Audioboom podcasts while Nova Entertainment also reps News Corp and DM Podcasts.

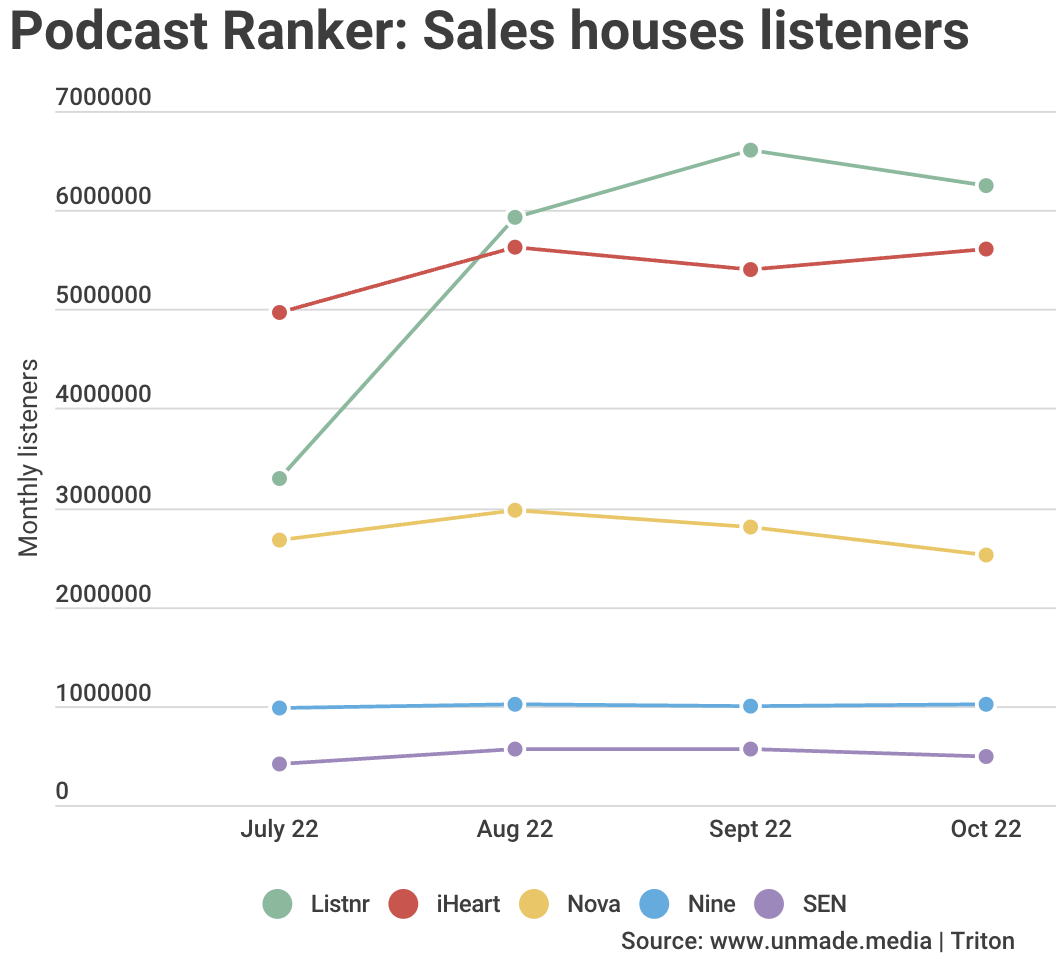

Listnr is the only operation to grow a network of more than 6m monthly listeners, while ARN has been pulling in around 5.5m. In a population of 26m, that means there’s a way to go, but it’s a start.

Nova is yet to hit 3m, while Nine is stuck on around 1m. The only other player to deliver more than half a million monthly listeners is SEN.

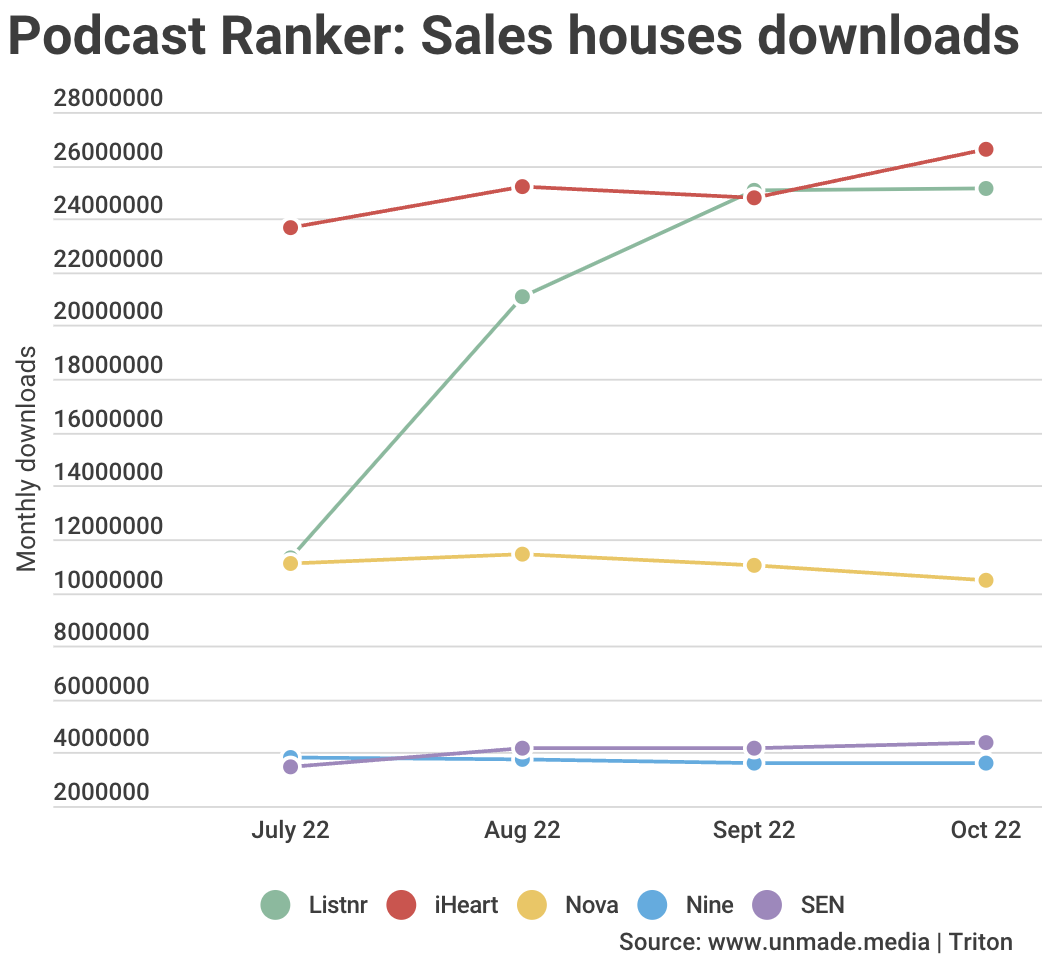

Meanwhile, in terms of monthly downloads, ARN has retaken the top slot from Listnr, delivering 25.2m downloads in October.

In the main, podcasts are monetised through advertising and sponsorship. There are two models – both of which require scale.

The first type – selling aggregated audiences, and niches within them, is what explains Listnr’s push to develop a sales representation model in order to scale up.

Last month not a single podcast reached 1m monthly listeners in Australia. And only 41 podcasts (29 of which were locally made) reached more than 100,000 Australian listeners.

So the long tail of niche podcasts is essential to provide a network audience, with advertising creative running across multiple podcasts, dynamically inserted to target the listener.

The practical effect of this bulking up is that marketers and media agencies are now able to buy audiences, rather than shows.

The second part of the model is closer to the traditional radio world. Only the larger podcasts (or those in a lucrative, ad-friendly niche) are the ones that can justify specific sponsorships, live reads and creative.

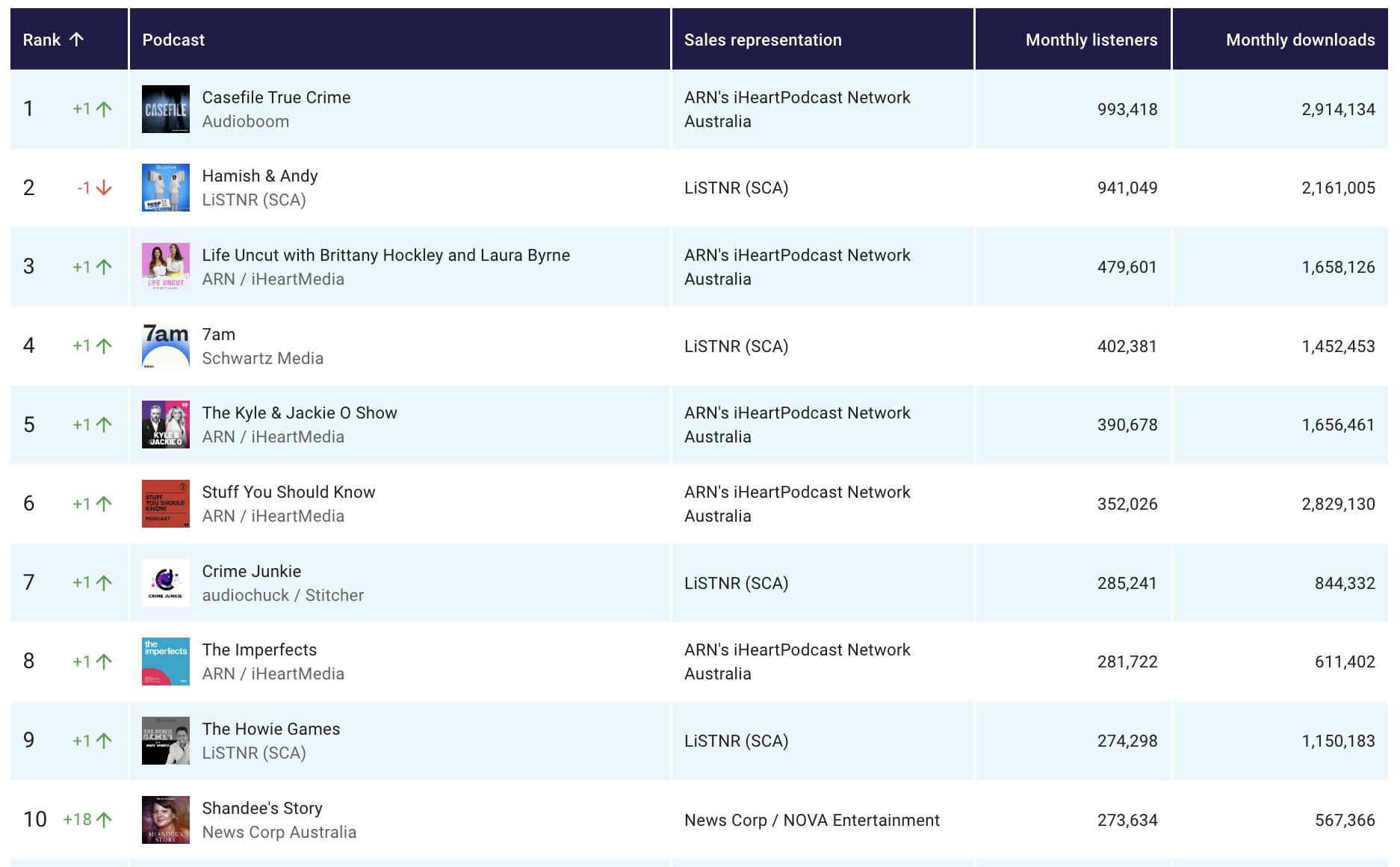

Take Listnr’s Hamish & Andy podcast, with Hamish Blake and Andy Lee, which was the second biggest podcast last month, behind the mystifyingly popular Casefile True Crime.

With more than 2m downloads per month and 941,000 monthly listeners, Hamish & Andy is a show worth putting effort into selling against, and creative resource into crafting specific sponsor messages against.

Something else stands out from yesterday’s data. Nine Radio – home of 2GB, 3AW, 4BC and 6PR – hasn’t really entered the podcasting battleground. It doesn’t have a podcast strategy beyond repurposing live to air content.

The fact that minnow SEN (Sports Entertainment Network) delivers more monthly downloads (4.4m) than the combined efforts of Nine Radio and Nine Publishing (3.6m) is extraordinary.

Indeed, if it wasn’t for the efforts of their newspaper colleagues in Nine publishing, Nine Radio would be even more embarrassed by the numbers.

The repurposed output of 2GB and 3AW is delivering about 780,000 downloads per month – the Nine Publishing team’s investigative journalism – often done off the side of a desk – is doing about twice that.

Arguably, the strategy is to not have a strategy. Nine may have decided it’s a space not worth investing in yet. Things are beginning to move in the business of podcasting now, so we’ll find out soon enough.

#RIPTwitter?

It felt like the end of school term on Twitter last night.

The hashtag #RIPTwitter trended for most of the day, and continued to do so this morning. Nostalgic users shared their favourite memories and said their goodbyes.

Plenty of people who understand software engineering better than me have formed the view that Elon Musk’s remaining engineers may not be able to keep Twitter up if something breaks.

It’s not even four weeks since Musk took ownership of the platform. During that time, he fired half the staff, laid off most of the company’s contractors, and this week gave remaining employees an ultimatum – they needed to confirm on a form that they were willing to do “extremely hardcore” hours going forward, or be considered to have resigned. Last night it began to look like most had called his bluff and left.

Having ruled that everyone had to work from the office, on Thursday all staff were locked out again until next week without explanation – although the best guess is that Musk fears sabotage.

Will the site simply stop working one day and never return? Unlikely. It reminds me of the panic around the Y2K bug. But the advertisers have been frightened off. That’s what’s going to kill Twitter.

Unmade Index – A little on the red side

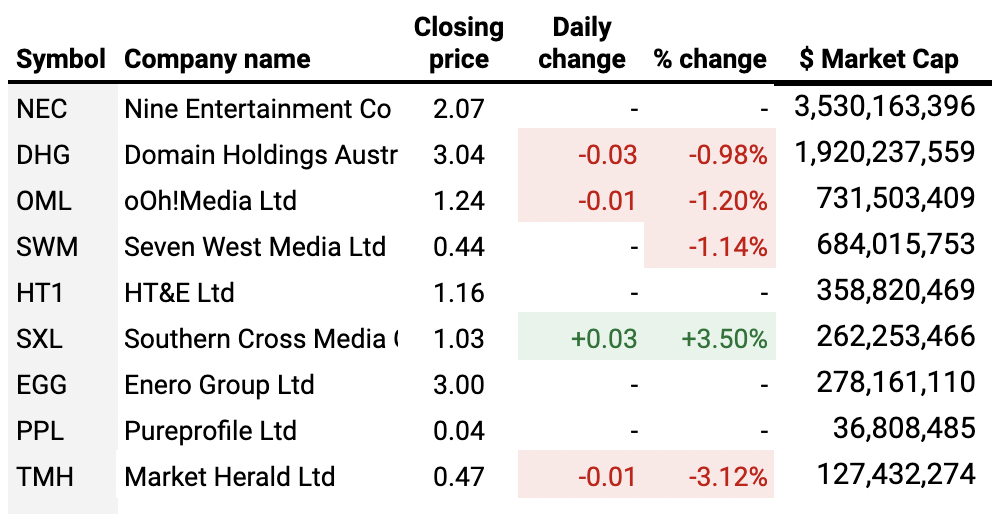

Having opened the week on 690 points, the Unmade Index finished down by about 2.6% for the week and 0.3% on Friday. It sank on every day except Wednesday.

One stock which went against the trend this week was Southern Cross Austereo, which has grown steadily in recent days – up by 3.5% yesterday, 8.4% for the week and 15% for the month. Based on the sum of its parts, it would be reasonable to assume SCA’s’s regional TV stations, Listnr streaming service and national radio operation would be worth more than its current quarter of a billlion dollar market capitalisation, if it was broken up. The moving share price might suggest that somebody has formed that view.

Time to let you go about your Saturday.

If you’d like a few more moments of my company, I once again played a cameo role in today’s edition of the Fear & Greed financial podcast, adjudicating the titanic battle between Adam Lang and Michael Thompson to decide the biggest stories of the week.

And I’ll be back with Abe Udy for Unmade’s Start the Week podcast on Monday. The new Roy Morgan newspaper readership numbers will be out by then. I don’t usually cover them, but this time, I was in the audience sample, which gives me a new perspective on the meaningfulness or otherwise of the readership figure. I shall opine my heart out.

Until then, have a great weekend.

Toodlepip…

Tim Burrowes

tim@unmade.media