Netflix numbers aren’t as bad as expected, but we’re still close to the streaming subs peak

Welcome to Unmade, kicked off just before dawn on Wednesday in frosty Sisters Beach, Tasmania, just as the quarterly Netflix numbers dropped.

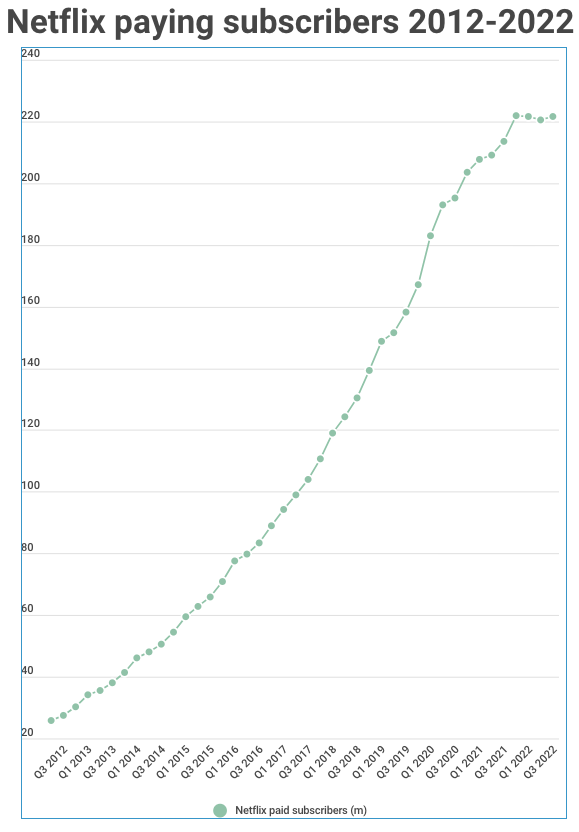

They were perhaps the most widely anticipated set of numbers since Netflix started releasing its paid streaming memberships data a decade ago. Three months ago, the company’s share price crashed when it told the market that for the first time, it expected the number to fall for the quarter by about two million – from 221.64m paid subs to 219.64m. Netflix shares are now worth just a third what they were at the start of the year.

We lean today that in the end, the drop was less than a million – falling by 970,000 to 220.67m. The company is predicting that, thanks to the fourth series of Stranger Things, and the accompanying Kate Bush mania, it will return to modest growth in the current quarter – back up to 221.67m, which would also represent growth on six months before.

Nonetheless, as you’ll see from our table above, it’s starting to look a lot like a plateau.