That was either Southern Cross Austereo’s last, and worst, financial results – or the turning point

Welcome to an end of week update from Unmade. Today, Southern Cross Austereo CEO John Kelly unveils his first set of financial results, but will they also be his last? And a bad day on the Unmade Index as a cold wind blows across the Tasman for the TV market.

Producing independent analysis of the media and marketing industry that goes beyond press releases takes time and resources. If you like what we do, you can support us by becoming a paying member. Become a member today

SCA reports another dismal set of numbers, but with Listnr about to become profitable, is that as bad as it gets?

In the rear view mirror, the Southern Cross Austereo jalopy just went through its bumpiest half of all time. There was a lot of red in the half year numbers released yesterday. TV revenue was down a lot, radio revenue a bit, and getting into the audio streaming game has been expensive. Debt was up slightly too.

The car is approaching a junction. The company, now under the leadership of John Kelly after the exit of Grant Blackley at the end of the last financial year, must soon decide whether to take the off ramp and accede to the ARN Media-led takeover bid, or continue on its own path with streaming platform Listnr about to start making, rather than losing, money.

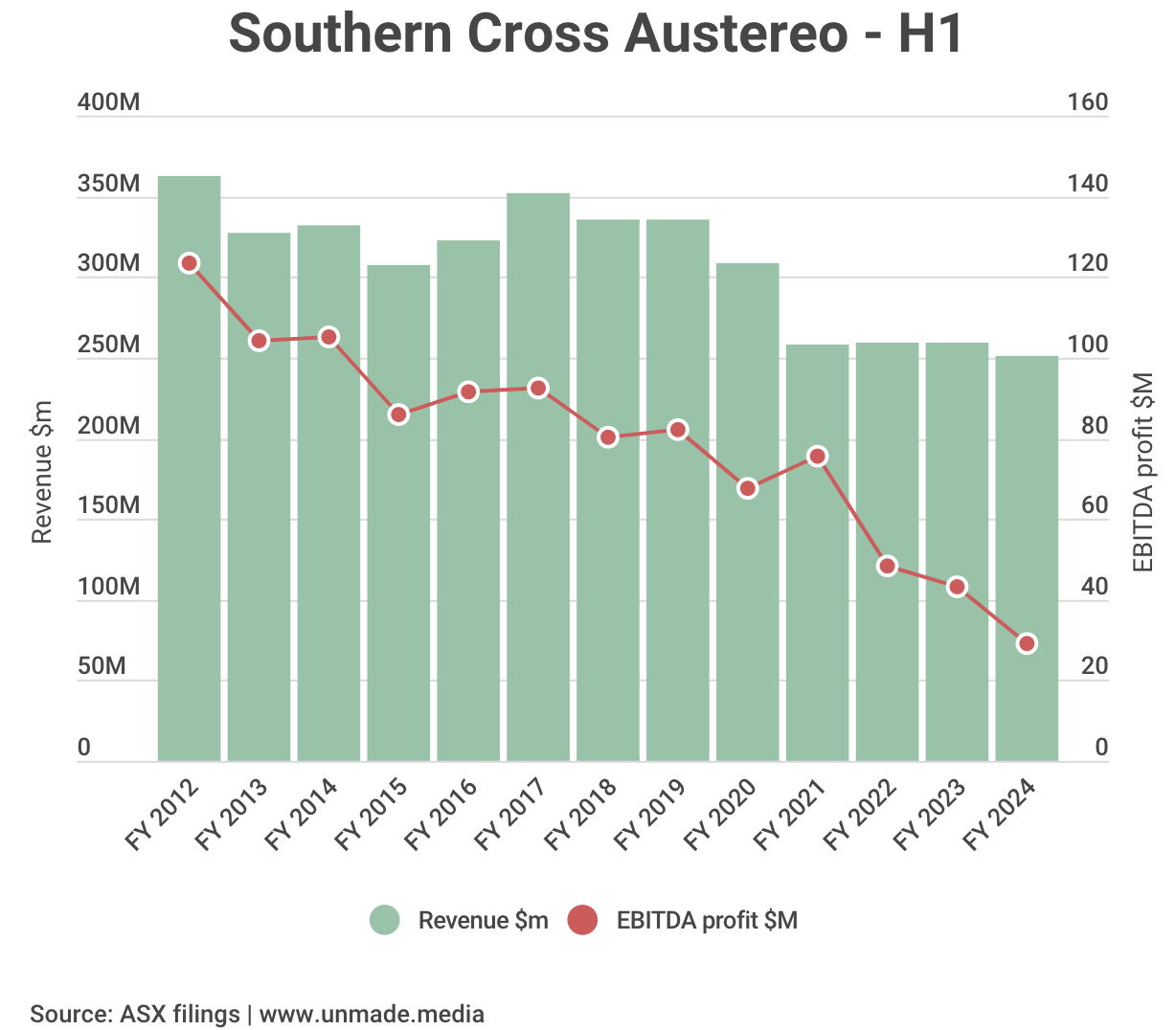

The graph for the 13 years since Southern Cross Media executed a $700m+ takeover of Austereo tells a sad story for shareholders.

From EBITDA profits (the red line) of $123m in the first half of the 2012 financial year, to just $29m in yesterday’s H1 FY24 update, the trend has been downwards. Revenue (the green bars) over the same period has fallen from $363m to $251m.

But the headline numbers never tell the whole story.

First, as a purely audio company, SCA is in better shape that the headline suggests. Its biggest problems are in its TV arm. Although radio revenues across its Triple M and Hit networks fell $4.1m to $184m, audio streaming was up by $3.3m to $15.6m. In this market, going backwards by only $800,000 overall almost counts as growth.

Television is where SCA is feeling most pain. Owning a regional TV licence gives all of the exposure of the linear downturn with none of the upside of the rise of BVOD. SCA is Network Ten’s regional partner, as well as carrying the Seven signal in some markets. The company’s TV ad revenue fell by $9.6m, caught in the pincers of Ten’s ongoing ratings squeeze and the downturn in the wider television market.

There’s a better story around audio though. SCA says that it has nearly completed the investment phase of building its streaming plaform Listnr. The next quarter will be the first where SCA does not need to put money into Listnr, which early in 2025 should start delivering a profit. With ARN in a long time deal to licence iHeart’s streaming technology, and Nova Entertainment doing the same with Global out of the UK, that offers a key point of difference.

Behind the scenes, SCA made $20m of savings – which will work out as $30m across a full year. In the main that has been achieved by leaving vacancies unfilled. With a headcount of 1550, that’s about 100 roles that have been taken out.

Together with accounting for the $8.6m loss on Listnr which won’t be repeated, SCA says that EBITDA would otherwise have been $49.6m, rather than $31.1m. If it achieves that number in the next financial year, than that would indeed reverse the downwards red line.

The biggest if in that sentence though, is whether the company, and its board, is still around to achieve those savings.

Last week ARN Media said that its takeover proposal, which it made four months ago, could be completed by the end of March – but only if SCA moves to due diligence, and recommends the deal to shareholders.

Kelly pointed out yesterday that because the offer isn’t just cash, but also stakes in ARN Media and in the new entity, his board needs to better understand the future financials of ARN – which would end up with the Triple M and Kiis networks – before recommending any deal.

He explained: “If they were just offering cash, there’s only one thing we need to do: That’s to say: this is the cash they’re offering, this is what we think the company is worth. Is it good value for our shareholders? That would have been done some time ago.”

Kelly argues that the ARN consortium with private equity house Anchorage hasn’t completed its homework. “The rub here is that the consortium need to have done a sufficient amount of work on what that ARN NewCo looks like, what the assumptions are, what the earnings are and provide a sufficient level of detail to us to make a comparable valuation against the value of our own business. That’s the work that hasn’t been completed yet in our view.”

Once ARN presents its projections, SCA may push for a bigger offer. Kelly argues: “We’ve got our own perspective on what the value looks like. We think the value has gone up since the offer came in, because of the cost out at Listnr.”

The fork in the road is approaching fast. The patience of some of SCA’s bigger shareholders is running out. They just want to take the money. Nervous about losing the deal, they may try to spill the board. The Australian Financial Review is reporting today that Spheria Asset Management plans to call an extraordinary general meeting.

The quote in the AFR from Spheria’s Matthew Booker is harsh: “We believe the transaction presented by ARN/Anchorage is in the best interests of … shareholders and the protracted negotiations risk the deal not eventuating, leaving the business with a stretched balance sheet in a challenging macroeconomic environment.

“Today’s result was poor, and we have little faith that the management team can extract the cost savings targeted. The company has had an appalling track record of meeting expectations hence its abysmal share price performance over a number of years. In our opinion, this will continue without shareholder intervention.”

Mind you, I’m not sure Spheria can claim to be long suffering. It only became a subtantial shareholder (passing the 5% threshold) in January, before upping that stake to 7% a few days later.

Fellow shareholders Allan Gray and Ubique Asset Management are reportedly on board on calling the spill too. Between them, that’s about 25% of the shareholder vote. Given the Takeover Panel’s disapproval of ARN’s previous purchase of 14.8% of SCA before launching the takeover bid, I’m not sure ARN would be able to participate in any spill vote which might make it a closer run thing.

Yesterday’s analysts call was an interesting one around market sentiment. There were no detailed questions about the takeover proposal. Instead, most of the focus was on performance in a tough market.

And there were alarmist questions too. Triggered by the defenestration of Newshub at NZ’s Three channel on Wednesday, by owner Warner Bros Discovery, one analyst wanted to know what plans SCA had for its regional TV licences if Paramount pulls the plug on Ten. Unlikely as that seems, the fact that the question was even asked on an investor call was a shock.

What seems certain is that there will be more changes in the TV market. Another theory gaining traction is that when ARN Media has resolved the takeover bid one way or another, the next target will be Seven West Media, perhaps as a merger of equals.

ARN’s enterprise value – market capitalisation plus debt – is currently approximately $350m, although that would likely be nearer $600m if it succeeds in the takeover. SWM’s enterprise value is currently around $580m.

Adding credence to the ARN-SWM theory was Seven’s decision to buy a 20% stake in ARN Media back in November. With SWM boss James Warburton out of the door in the next couple of months, there wouldn’t even be much of a leadership battle

Rarely has a half year update come at such a sliding doors moment.

Declaration of interest: Through my super fund, I own shares in both SCA and ARN Media

TV stocks take a tumble

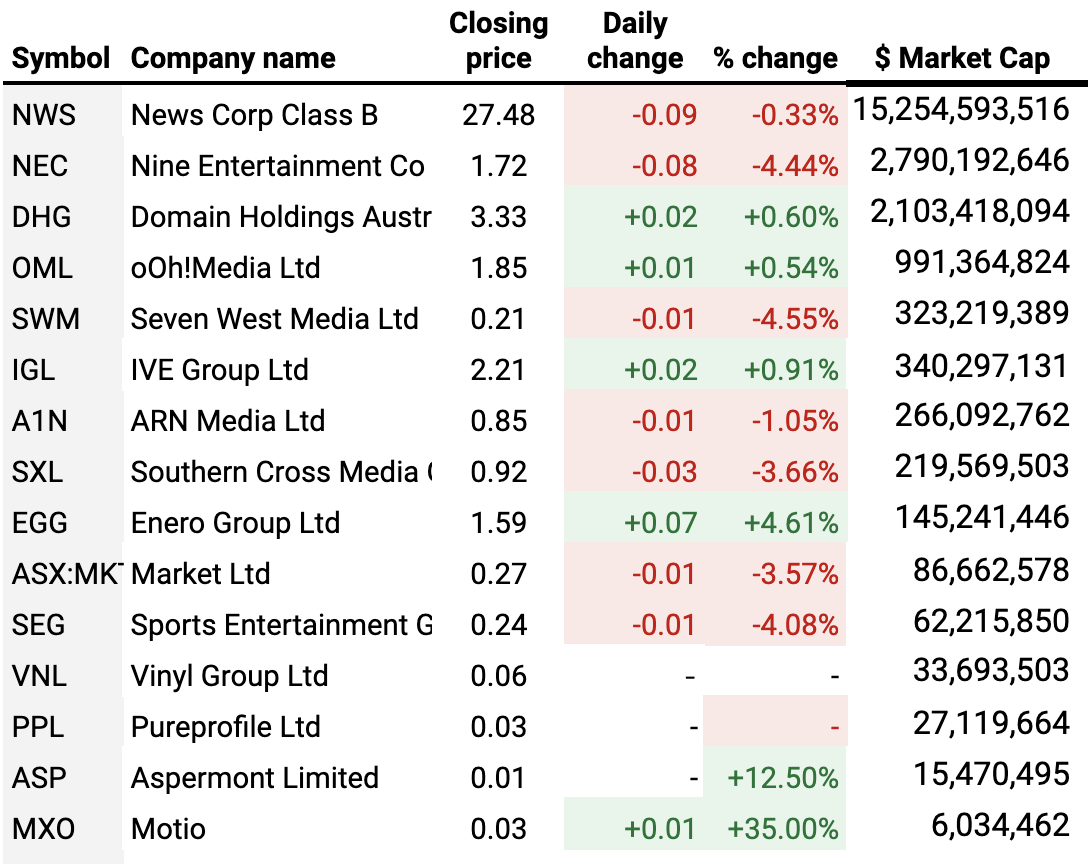

Television companies had a brutal day on the ASX, likely triggered by the radical cost cutting by Warner Bros Discovery at NZ’s free-to-air Three network on Wednesday feeling close to home.

Seven West Media, which has the biggest proportion of its business exposed to the TV market, lost 4.55%.

As a result, SWM dropped to being Australia’s sixth largest ASX-listed media and marketing stock after being overtaken from market capitalisation by print and marketing house IVE Group.

Nine slumped by 4.44% to a market capitalisation of $2.8bn.

Southern Cross Austereo saw a big fall earlier in the day when it released its half monthly results, but recovered to a loss for the day of 3.66%. SCA’s biggest rival ARN Media lost 1.05%. And the third listed audio stock, the minnow Sports Entertainment Group, lost 4.08%.

Enero recovered some of yesterday’s losses and improved by 4.61% yesterday.

At the microcap end of town, Motio bounced back from Wednesday’s 20% fall and gained 35%.

Time to leave you to your Friday.

I’ll be back tomorrow with Best of the Week. There’s a lot to think about, including the Newshub shock in NZ; takeouts from the IAB’s audio summit, financial results from Enero, IVE Group, Pureprofile, Sports Entertainment Group and Motio; and more big moves around AI from Google.

Have a great day.

Toodlepip…

Tim Burrowes

Publisher – Unmade

tim@unmade.media