Netflix CFO credits ongoing success to building assets, not buying them

“More members, higher subscription pricing and increased ad revenue”: the reasons for Netflix’s 16% leap in revenue for the second quarter of 2025 seem obvious when stepped out in the company’s recent presentation, but behind the company’s incredible continued growth is a simple strategy to build assets rather than buying them.

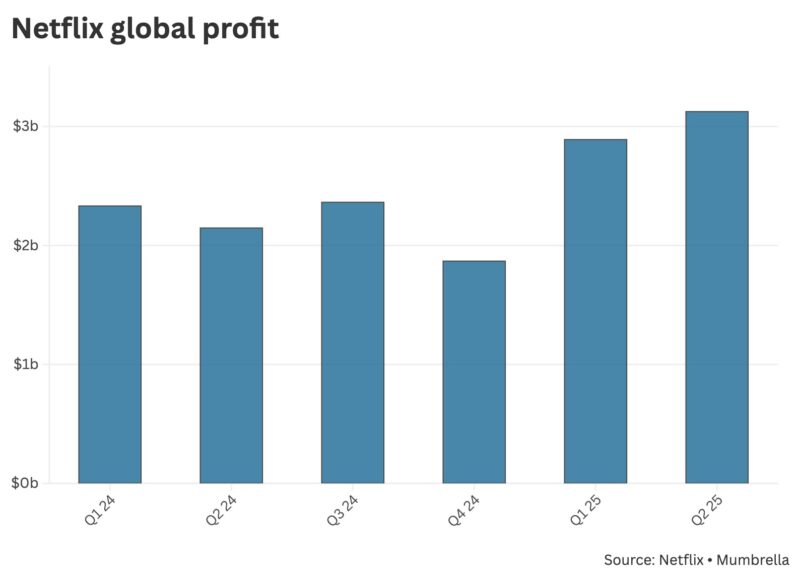

Netflix posted revenue of US$11.08 billion (A$17.03b) for the June quarter, ahead of Wall Street estimates of US$11.07 billion, and up 15.9% year-on-year. Net income (profit) was US$3.13 billion (A$4.76b) up from US$2.15 billion, with every region enjoying double digit revenue growth. See the graph below for trended profit over the past six quarters.

Netflix’s quarterly profits hit an all-time high in the latest quarter