Tuesdata: How media shareholders were slashed by the falling knife

Welcome to Unmade’s final Tuesdata of the year.

Today we look back on how the nine ASX-listed media and marketing businesses fared in 2022.

The full version of this email is only available to Unmade’s paying members. Everyone else will hit a paywall further down.

There are three new reasons why it’s a good day to sign up.

We’ve locked the archive. All of our posts that are more than two months old are now available to our paying members only;

The Unmade annual membership now includes one hour of confidential consulting with Tim Burrowes on publishing, or trade press strategy.

The standard annual price of $650 has been reduced to $338 – but only if you sign up this week, via the button below. The price will never be that low again.

A dismal year for media investors

This time last year we named a CEO of the year. From the eight ASX-listed media and marketing companies which we track on the Unmade Index, we calculated who had delivered the most shareholder growth.

In 2021, it was Seven West Media’s CEO James Warburton. He grew the company’s market capitalisation by $477m last year.

This year there’ll be no CEO of the Year. Without exception, every company on the Unmade Index lost market capitalisation.

It seems unfair to lay that at the doors of the respective CEOs when most of the decline was because of fading sentiment about the media sector globally, combined with a healthy dose of fear about the year to come. The Sydney Morning Herald obtained an early look at the November Standard Media Index numbers yesterday, and it looks like the post lockdown run is over.

The market has already priced in a decline, and has been downgrading media stocks all year.

We began the Unmade Index at the start of 2022 with a nominal opening value of 1000 points. It never traded above that point all year. It closed yesterday at 646.3 points. That’s a fall of 35.37%.

The worst day came on June 16, when the Unmade Index bottomed out at 587.05 points – a fall of 41.2% on the year’s opening. A fall of 20% represents a bear market. A fall of 40% is perhaps the metaphorical version of being attacked by a drop bear.

To put it another way for non investors: Even with the slight recovery from the June low, if you’d bought $1,000 worth of media shares on January 1, your investment is now worth $646.

Because of the painful way that maths works, those investors will now need to see their shares grow by 55% just to get back to where they started.

Although we won’t name a CEO of the year, we’re not going to name a dunce of the year either. We will, however, calculate how much market capitalisation each business has lost, and put it in ranked order. You can call that whatever you like.

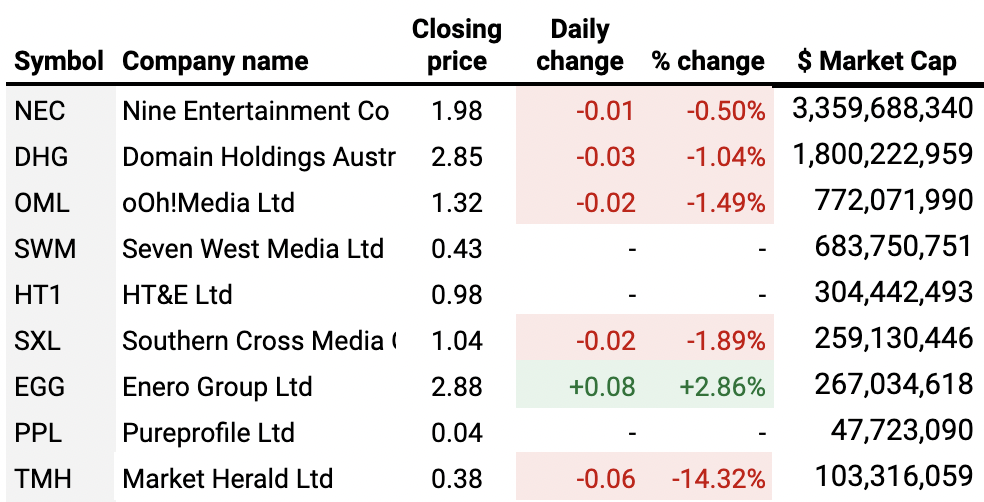

In alphabetical order, the nine organisations featured are: Domain, Enero, HT&E, The Market Herald, Nine, Ooh Media, Pureprofile Seven West Media and Southern Cross Austereo.

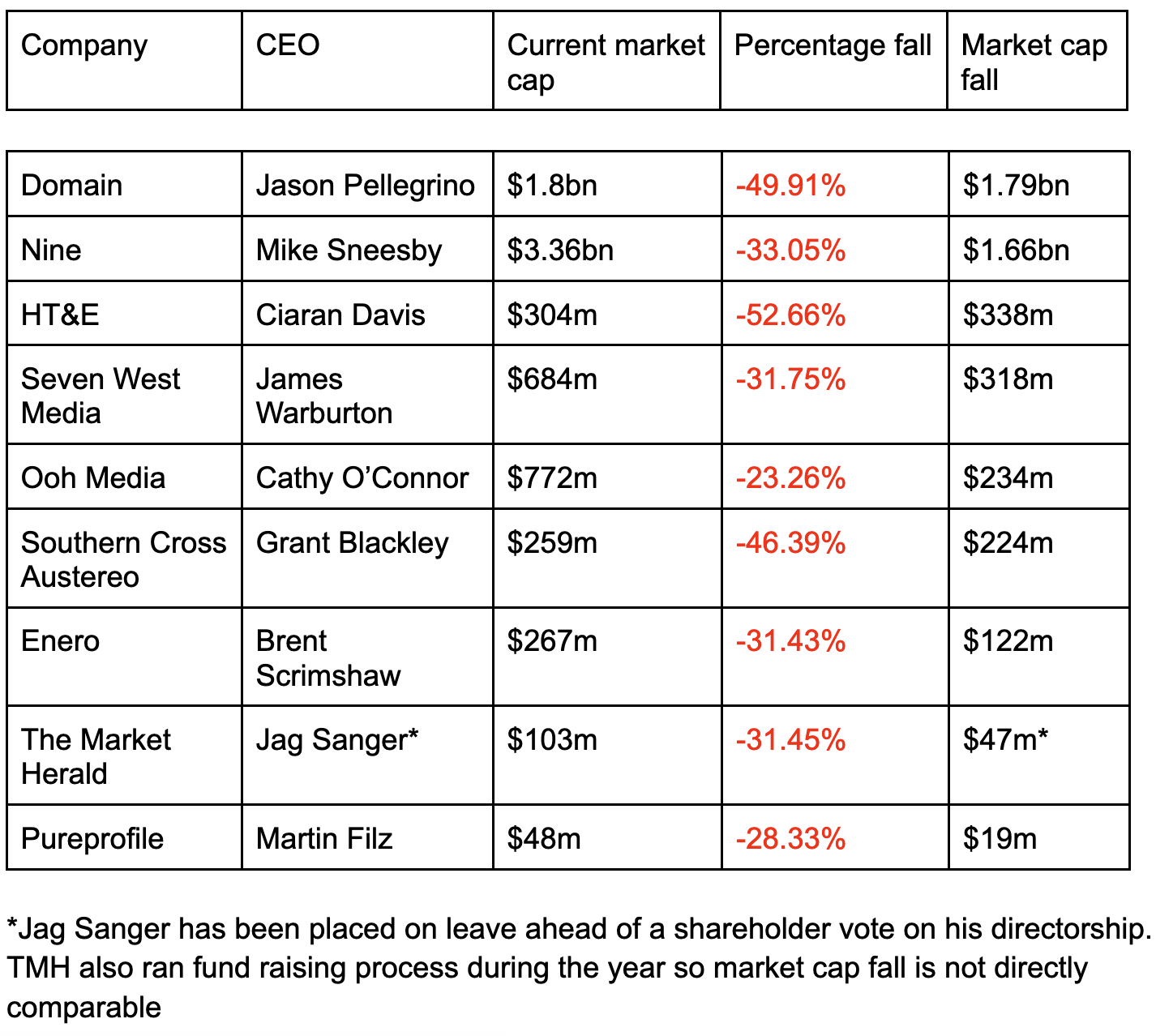

We’ll provide two tables. First, the biggest market cap losses in dollar terms, then in percentage terms.

Biggest falls in market cap:

In terms of fall in market capitalisation, Domain boss Jason Pellegrino has overseen the biggest fall, with a loss of $1.79bn in value.

The drop in value of Domain also had an impact on the valuation of Nine, which still owns a majority stake.

Meanwhile, Mike Sneesby’s first full calendar year in charge at Nine saw his shareholders lose $1.66bn.

Meanwhile, if not the best, then Ooh Media can at least claim to have been the least worst.

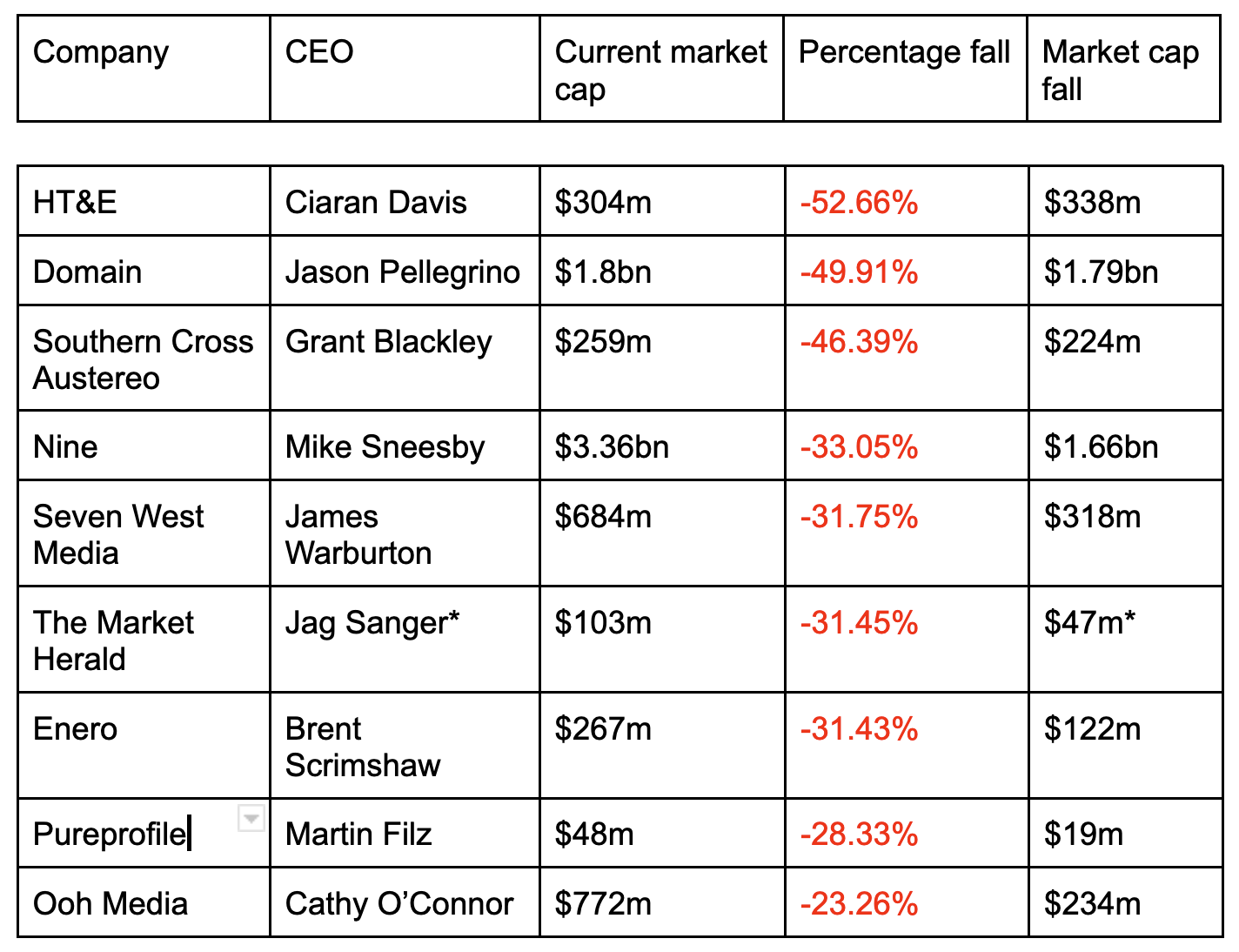

Reordering the companies by percentage fall tells a subtly different story…

Biggest percentage falls

In terms of companies that saw their share price fall the furthest in percentage terms, that dishonour falls to HT&E’s CEO Ciaran Davis. The parent company of audio group ARN saw its share price fall by more than half – the only one to do so. The company fell from a $640m valuation to $308m.

His counterpart at Southern Cross Austereo, Grant Blackley, was not far behind. Blackley oversaw a 46.4% decline in value, representing a fall of $224m.

Of course, the ASX still has a few trading days until the year end, although volumes are already falling. If there’s to be a Santa rally, it’s late this year. We’ll continue to monitor the daily Unmade Index in our final editions of the year.

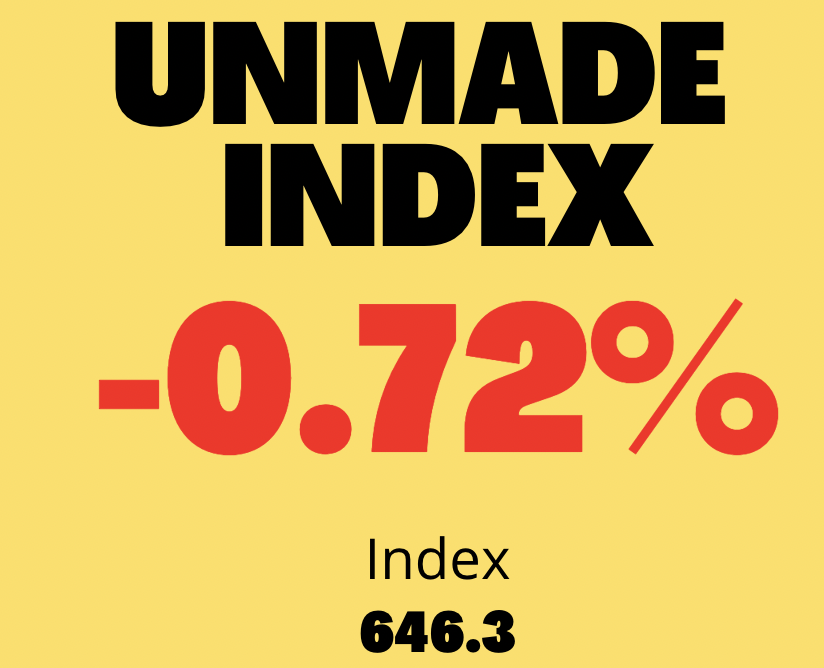

Unmade Index: Fourth day of falls

Speaking of which, yesterday saw the Unmade Index fall for a fourth trading day in a row, dropping by another 0.7%.

The Market Herald’s share price continued to be volatile as shareholders prepare to vote on whether to retain founder Jag Sanger as a director. Yesterday the share price fell by 14.3% to 38c.

The company has until this Thursday to call a meeting to vote on the attempt by the Argyle family, who own about 40% of the shares, to unseat Sanger. According to ASX rules, the meeting will need to take place before February 1.

The company also faces a deadline of March 31 to find $60.1m to complete its purchase of Gumtree, Carsguide and Autotrader.

The TMH price was at 50c when the Argyles kicked off the spill on December 1.

Time to leave you to your Tuesday.

One more announcement before I go.

As a paying member of Unmade (thank you, by the way), you get a 30% discount on early bird and full price tickets to our Re:Made – Retail Media Unmade event in March.

That reduces the price of your $295 ticket to just $165.

You’ll need to put in a voucher code on the website to get the reduction, and this is it: Unmade_Members_EB

If you hit any issues, feel free to email us at events@unmade.media.

I’ll be back with more tomorrow.

Have a great day.

Tim Burrowes

Publisher – Unmade

tim@unmade.media