Tuesdata: How the salaries of ASX-listed media and marketing CEOs stack up

Welcome to Unmade’s new regular data post, Tuesdata. No prizes for guessing where the name came from.

Tuesdata will take a look at various data points across the media and marketing industry and will be available to paid subscribers only. Our monthly exclusive Canda data on the top ads by spend and spot will be part of Tuesdata.

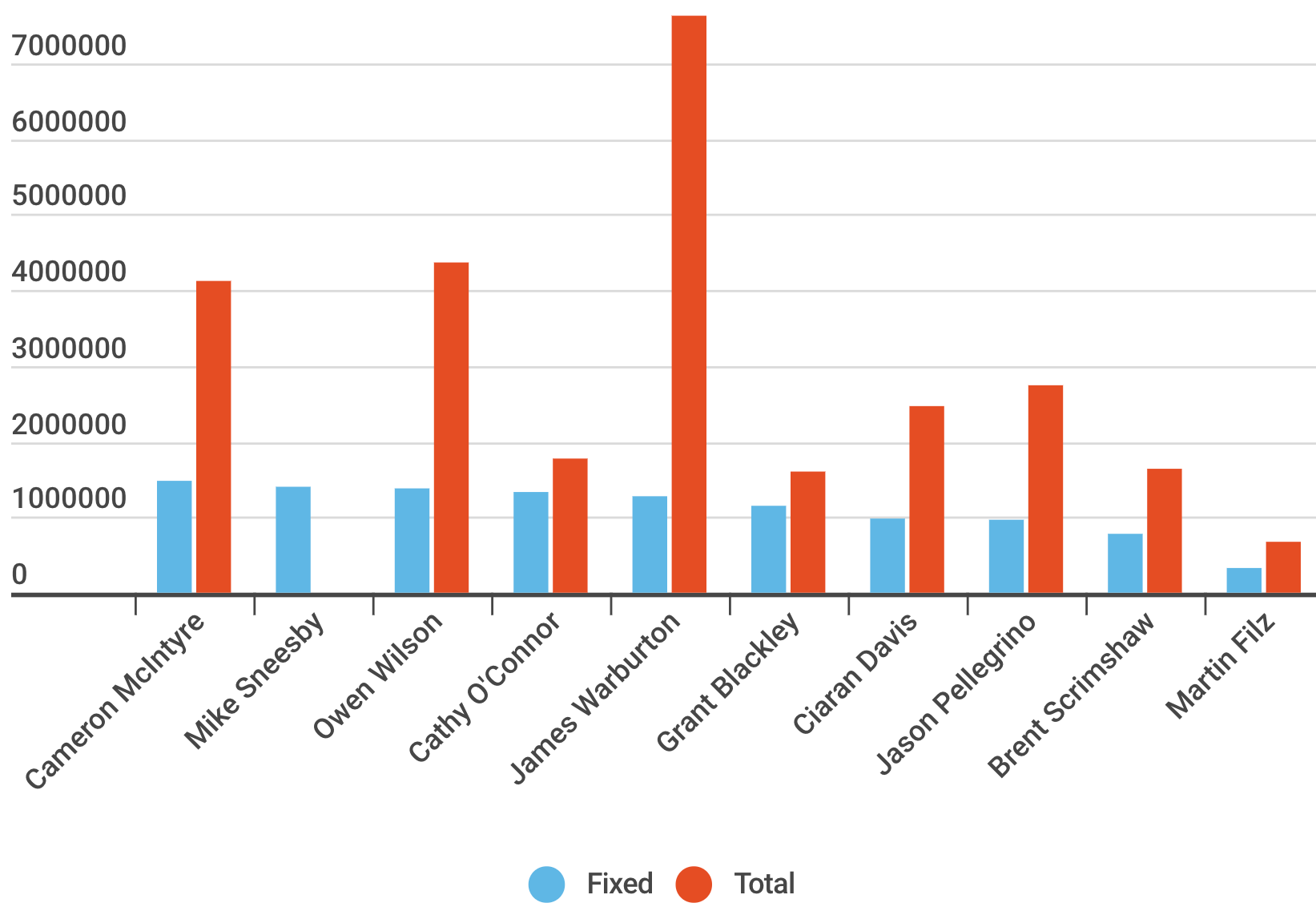

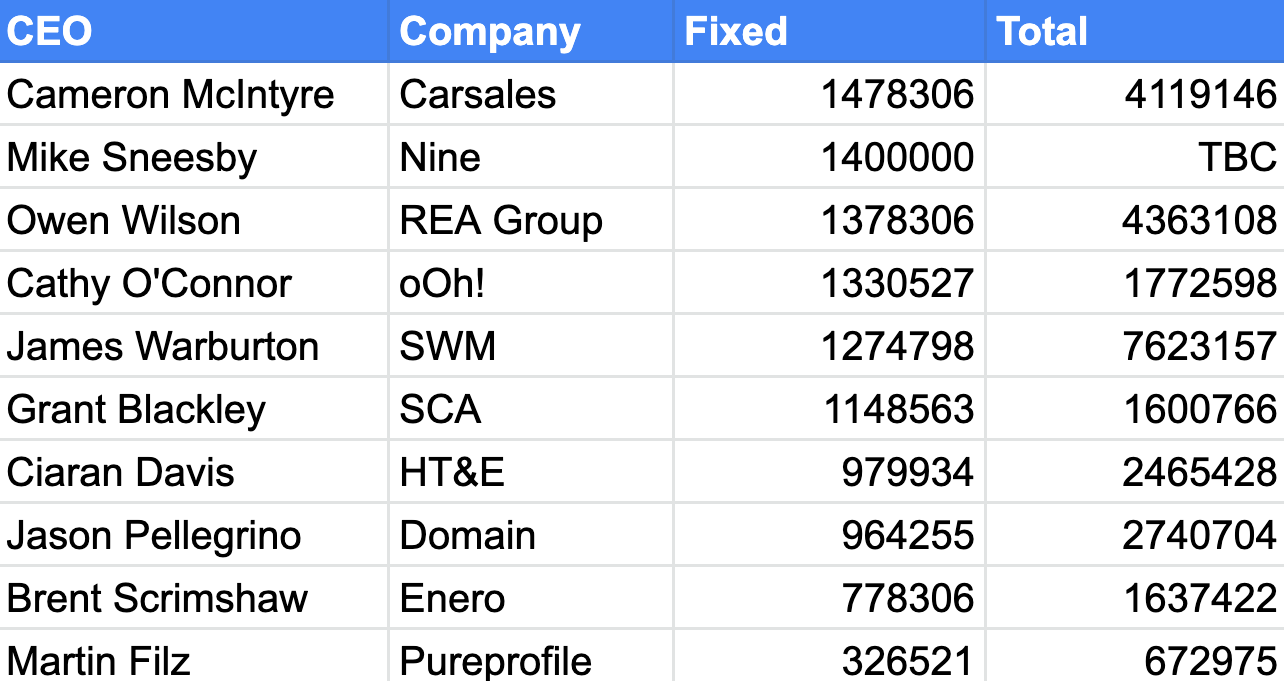

Today we are comparing the remuneration of CEOs of ASX-listed companies by fixed and total remuneration.

The full content of this post is for Unmade’s paying members only. Others will hit the paywall a little lower down.

We’ve gone through all of the most recent annual reports to rank the highest paid in order of their fixed remuneration, but have also included their total as well so you can see what they were really rewarded with.

There’s no perfect time to do this comparison, with companies on this list reporting at various times of the year. Towards the end of last year we did a smaller comparison and awarded James Warburton CEO of the year.

We now have the most recent results were from Ooh Media, which reports on the calendar year and therefore was able to provide data on a full year for CEO Cathy O’Connor.

Carsales, REA Group, HT&E, SWM, Ooh, Domain, SCA, Nine, Enero and Pureprofile are listed on the ASX. While News Corp is dual listed on both the NYSE and ASX, it does not provide details for Australian boss Michael Miller.

Of the 10 companies we’ve included here, O’Connor is the only female CEO

There is one incomplete data point on this list, and that is Nine CEO Mike Sneesby. One of the highest profile CEOs thanks to the scale of Nine, he began his tenure on April 1, 2021 and therefore has not recorded a full year’s salary in a financial year.

Despite this, it still doesn’t place him at the bottom of the pile, and with a fixed salary of $1.4m, he can be expected to be well within the top five after this year’s annual reports.

The list of CEOs in order of fixed remuneration

1. Cameron McIntyre

Fixed salary: $1,478,306

Total: $4,119,146

Total as a multiple of fixed: 2.79

McIntyre’s base of almost $1.5m puts him narrowly in the lead as the highest paid media and marketing CEO in the country by fixed remuneration. The last year has been a good one for the Carsales boss.

Covid did two things that significantly helped Carsales. It encouraged Australians to renew their car or purchase another car while also accelerating the uptake of negotiating and purchasing vehicles online.

New vehicle sales in Australia climbed 14.5 per cent in 2021 compared to the previous year according to VFacts. This was despite long wait times and supply issues.

McIntyre and his team didn’t let the opportunity pass the business. Carsales sessions increased 21% in FY21 while listed cars sold 28% quicker. WIlson also launched journey planner and rideshare comparison app Placie in Australia. Overall, Carsales reported revenue was up 8% globally to $427.2m while NPAT went north 9% to $130.7m.

For his efforts, McIntyre earned 2.79 times his fixed salary to creep over the $4m mark, one of only three CEOs in this list to break $4m, thanks in part to $1.241m in short term cash incentives.

2. Mike Sneesby

Fixed salary: $1,400,000 (Part year FY21 was $344,576)

Total: $TBC (Part year FY21 was $869,775)

Part total as a multiple of part fixed: 2.52

Former Stan CEO Mike Sneesby was the somewhat surprising choice to lead Nine Entertainment Co. after the resignation of Hugh Marks. While he hasn’t yet served a full financial year, his total remuneration as a multiple of his fixed has him tracking in the right direction to take home a significant total amount.

His appointment inevitably led to some senior Nine executives once considered in the frame for the role departing (namely Chris Janz and Lizzie Young), but he’s been quick to make moves which solidify Nine’s position as Australia’s largest media company.

A new five year deal with the NRL, integration of WIN regional sales staff directly into the Nine business and the somewhat predictable appointment of acting-CEO of Stan, Martin Kugeler, into the position on a permanent basis are all ticks for Sneesby.

So was the ability to announce an 8% increase in revenue YOY in the most recent annual report. The market, however, still seems cautious on Nine’s prospects. The share price is currently sitting at $2.41, not greatly higher than its 52-week low of $2.27, admittedly in a difficult market.

3. Owen Wilson

Fixed salary: $1,378,306

Total: $4,363,108

Total as a multiple of fixed: 3.17

Covid delivered mixed news for REA Group and Wilson – an increasingly competitive property market on the residential side but mainly due to lower levels of stock. And on the commercial side, obvious declines in stock interest.

Despite this, revenue increased 13% to $870 million in FY21, which the group put down to increases in the residential, developer and data businesses. Wilson also managed to deliver on the very first day of the new financial year, with the REA acquisition of Mortgage Choice completing.

In June last year REA also announced the purchase of 34% of mortgage and applications e-lodgement solutions business Simpology.

Realestate.com.au is winning the eyeballs battle as well, recording 3.3 times more views than Domain.com.au according to its annual report.

Despite this, REA Group has not been able to shield itself from challenging market dynamics, with its share price at $108.53 on May 19, down from $171.37 on Jan 4. It predicts further headwinds for Q4 FY22 as the RBA looks to continue to lift interest rates.

4. Cathy O’Connor

Fixed salary: $1,330,527

Total: $1,772,598

Total as a multiple of fixed: 1.33

O’Connor came to Ooh highly rated after an impressive stint at Nova for 12 years, five of which was as CEO. That is reflected in the fact that O’Connor earned one of the highest fixed salaries of any of the CEOs on this list. Her total remuneration as a multiple of her fixed was the lowest on this list, but with the outdoor industry still in recovery mode, that is to be expected.

With the pandemic all but shutting down outdoor media, and businesses in the sector at the mercy of lockdowns and vaccination rates in its attempts to kick start itself, O’Connor in part had to go for a ride she wasn’t in control of.

She wasted no time bringing in new talent, including Raechel Gavin as chief people and culture officer, who previously had built Quantium’s HR department from scratch. She also hired Mat Yelavichas as chief technology and information officer, previously group chief information officer at Nine.

Grabbing bigger headlines was the sale of youth publisher Junkee Media. Announced in July and purchased by Racat Group in December last year, it was a significant part of O’Connor’s strategy to have oOh! refocus on outdoor.

While rumours suggest Racat Group purchased Junkee Media for as low as $3m, O’Connor kept hold of Junkee Studios, which was recently rebranded as Poly and will aid brands to capture consumer’s attention using outdoor media.

She also managed to retain the services of half of Junkee’s founding team, with Neil Ackland now the CEO of Poly as well as the chief content, marketing and creative officer at oOh!.

5. James Warburton

Fixed salary: $1,274,798

Total: $7,623,157

Total as a multiple of fixed: 5.98

The leader by a long way in terms of total remuneration. Warburton’s road to the top of Seven West Media had its fair share of twists after he initially left SWM in 2011 to become CEO of Network 10.

A year at the top of the embattled third commercial network resulted in him being let go before stints leading the V8 Supercars and APN followed before he made it back to Seven and the top job in 2019.

His performance while at Seven has been impressive. Named as Unmade’s CEO of 2021, Warburton has so far managed to sell Redwave radio stations in WA, Pacific Magazines to Bauer Media which then became Are Media, and acquire Prime Media, which turned out to be a big task after the initial merger opportunity was blocked by Antony Catalano and Bruce Gordon.

It’s probably a good idea to be reminded of just how dire a position SWM was in only a couple of years ago. Best of the Week from August 29, 2020, summed it up well when Tim Burrowes wrote that 2020 and the arrival of the pandemic had turned the SWM story into one of survival. Possible receivership was even discussed. The day before that post, shares in SWM sat at just 12c.

2022 now looks like it will be a year of consolidation for Seven. With the share price at 64c and having been as high as 80c, SWM chairman Kerry Stoke’s defence of Warburton’s salary in the company’s AGM last November seems reasonable.

FY21 saw Warburton achieve positive outcomes in all components of the STI plan, including “significant over achievement” in the financial component and “over achievement” in the strategic component as well as the people, operations and compliance component.

6. Grant Blackley

Fixed salary: $1,148,563

Total: $1,600,763

Total as a multiple of fixed: 1.39

Will Grant Blackley remain as CEO of SCA for the rest of the year? Last week he publicly denied rumours that the business was actively looking for his replacement, instead suggesting it was BAU for SCA to have a plan B in case any senior executives left the fold.

But with SCA struggling in both ratings and share value, it’s not a surprise to see those rumours surfacing.

The ratings struggles have been long documented, particularly the situation of the breakfast slot in Sydney. The company finished the year with the bottom station in all five metro FM markets.

On the share front it currently sits just 1c above its 52-week low.

In the aforementioned post on the CEO of the year, Unmade also assessed SCA’s opportunities moving forward. Podcast platform Listnr was the one opportunity it had to reset its fortunes as the way regional TV played out in 2021 left SCA in a less than ideal position if it wanted to sell off its TV arm.

If the recent calculations on podcasts as a business prove to be correct, Listnr may not provide the help that SCA needs.

7. Ciaran Davis

Fixed salary: $979,934

Total: $2,465,428

Total as a multiple of fixed: 2.52

A surprisingly low fixed salary if you consider the stature of Davis and his achievements while at the helm of HT&E, although his performance sees a significant multiplier on that for his total remuneration.

During his tenure he’s managed to convince Kyle Sandilands and Jackie Henderson to jump ship to ARN, overseen the acquisition of regional radio’s Grant Broadcasters, earned the business $31m when it divested in Ooh earlier this year and has led the strategy of simplifying the business to focus on audio.

The most recent annual report has group revenue up $29m to $225m while EBITDA rose to $59.8m, up 21%.

Importantly, a long running tax dispute with the ATO relating to 2009-2016 was also resolved late last year with HT&E having to pay $71m to finalise the matter.

8. Jason Pellegrino

Fixed salary: $964,255

Total: $2,740,704

Total as a multiple of fixed: 2.84

The former managing director of Google Australia has now served almost four years at the helm of Australia’s challenger brand when it comes to real estate. During that time, shareholders and analysts have liked what he has done, with the share value steadily increasing since his appointment, Covid blip in early 2020 aside.

That was until this year, where Domain’s value has dropped from $5.07 at the start of the year to where it currently sits at $3.21. Despite this, FY21 was a relatively successful one for Pellegrino and Domain.

Domain Group revenue exceeded the targets set for the FY21 EIP (executive incentive plan) by 8% while EBITDA exceeded the targets set by 22%, with a result of $100.6m. It meant that Pellegrino achieved the maximum EIP award in relation to the financial performance measures.

Overall, he earned 80% of the maximum EIP, the best result he has had over the past three years, with the annual report noting that it was only in transformational initiatives that he fell below target.

9. Brent Scrimshaw

Fixed salary: $778,306

Total: $1,637,422

Total as a multiple of fixed: 2.1

Enero Group is the last remaining advertising network to be listed on the ASX. The group which includes BMF, Orchard, Hotwire, The Leading Edge and more has been proving to be good value for shareholders under the guidance of Scrimshaw.

Although he is one of the lowest paid by fixed remuneration, his total package more than doubles it thanks to significant performance on the market.

Like many on the ASX, the beginning of the year has seen value drops, however, Enero Group still sits at a relatively high point for its value over the last five years. Not surprising considering net revenue was up 18% in the last annual report.

The momentum has continued into 2022 with Scrimshaw appointing a new CEO for Orchard in Wai Kwok, one of the original founders of the agency. Meanwhile, its H1 FY22 update has seen further revenue growth, up 15.1% to $93.2m.

10. Martin Filz

Fixed salary: $326,521

Total: $672,975

Total as a multiple of fixed: 2.06

A tiny fixed remuneration and an equally small total when compared to the big media and marketing players above, but that’s not to downplay the importance of Filz to Pureprofile, a business that just two years ago was posting losses and carrying significant debt.

Filz took the helm in July 2020 and since then shares in the business have risen from 1c to be sitting at 4.8c, even recording a 52 week high of 8.8c. That means Pureprofile now has a market cap of $58.45m.

H1 of FY22 has continued the momentum with revenue increasing 44% and EBITDA 53%. It also boasted 137 new clients in the last 12 months.

Deserving of an increase in salary and bonuses, but it would still see him at the bottom of the media and marketing business bosses salary chart.

Time to let you get on with your Tuesday and perhaps mull over your own remuneration. As ever, we welcome feedback. Drop us a line at letters@unmade.media.

This evening marks the first live event Unmade is running. Tickets have now sold out but a special edition of the Unmade podcast with a recording of the panel will be released for paying subscribers soon.

Enjoy your Tuesday.

Damian