Tuesdata: How the social media platforms rose and fell over the last 12 months

Welcome to the first edition of Tuesdata for 2023. The full post is for Unmade’s paying members.

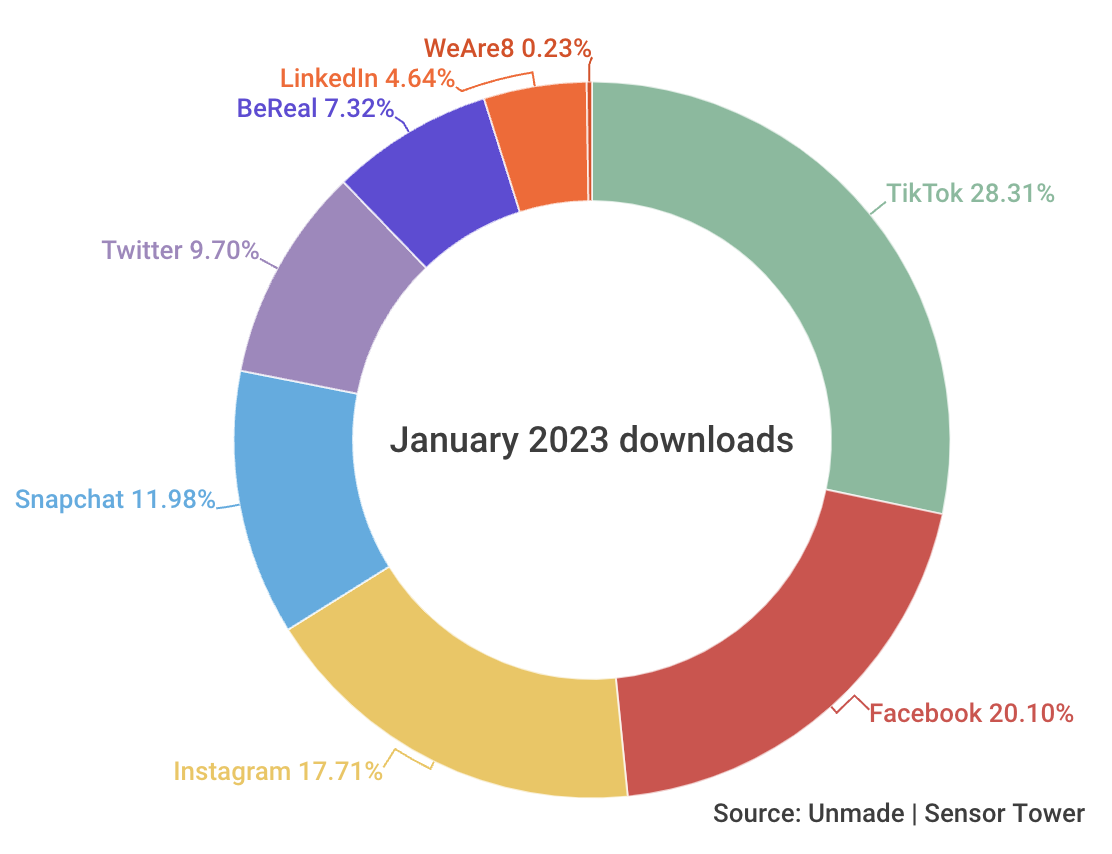

Today’s dataset, supplied to Unmade by Sensor Tower, explores download numbers for all the major social media platforms. We wrap up the data for all of 2022, and also offer an additional update on the share of downloads in January 2023.

Key trends:

BeReal appears to have peaked, while TikTok is demonstrating greater staying power;

Despite a significant marketing campaign, social good app WeAre8 is struggling to make a dent, but did grow a little;

Meta’s Facebook and Instagram have returned to growth;

Twitter also grew slightly

The content of the full post is available only to Unmade’s paying members. Today is a good day to join. Not only can you see the specific download numbers in this edition, you’ll also gain access to our Tuesdata archive.

Unmade’s paying members also get a 30% reduction in the ticket price for our conference RE:Made – Retail Media Unmade, which is now less than a month away, on March 2. The discount code appears at the end of this email, beneath the paywall.

Below the paywall, we also wrap up the movement on yesterday’s Unmade Index.

A bounceback for the three stalwarts

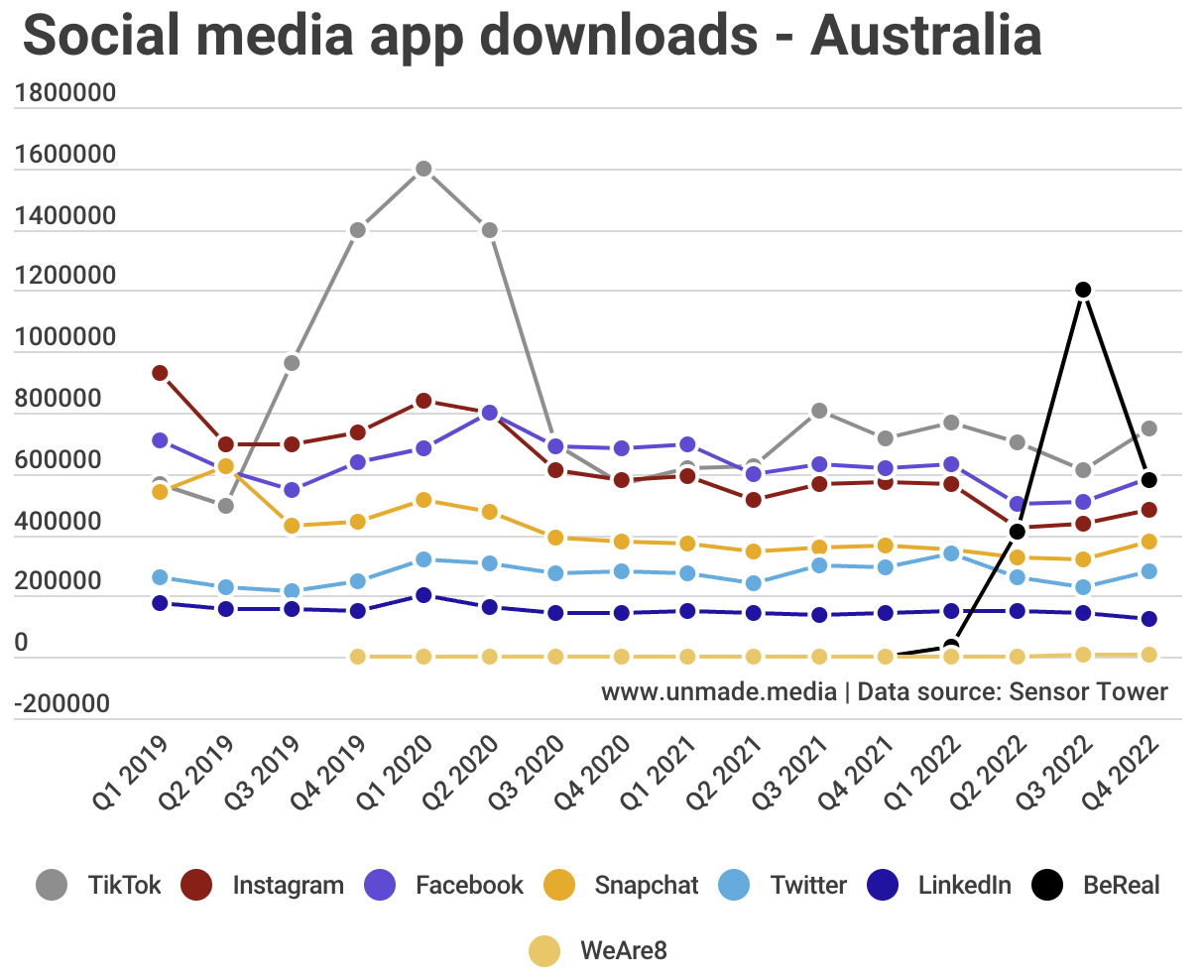

In today’s Tuesdata we examine seven of the major social media platforms, plus UK-Australian social good startup WeAre8.

It’s worth emphasising that this data shows new downloads – not monthly active users. It’s an indication of momentum.

Sensor Tower is a media intelligence platform which tracks app downloads via both Google Play and the Apple App Store. Because neither Google or Apple share this data publicly, Sensor Tower takes a panel-based approach. Effectively, that means the data is Sensor Tower’s best guess based on the behaviour of the consumers in its panel, which it says is the biggest of its type globally.

The numbers shown are based around individual Apple IDs and Google Play accounts, and automatically exclude app updates, or re-downloads onto new devices with the same ID.

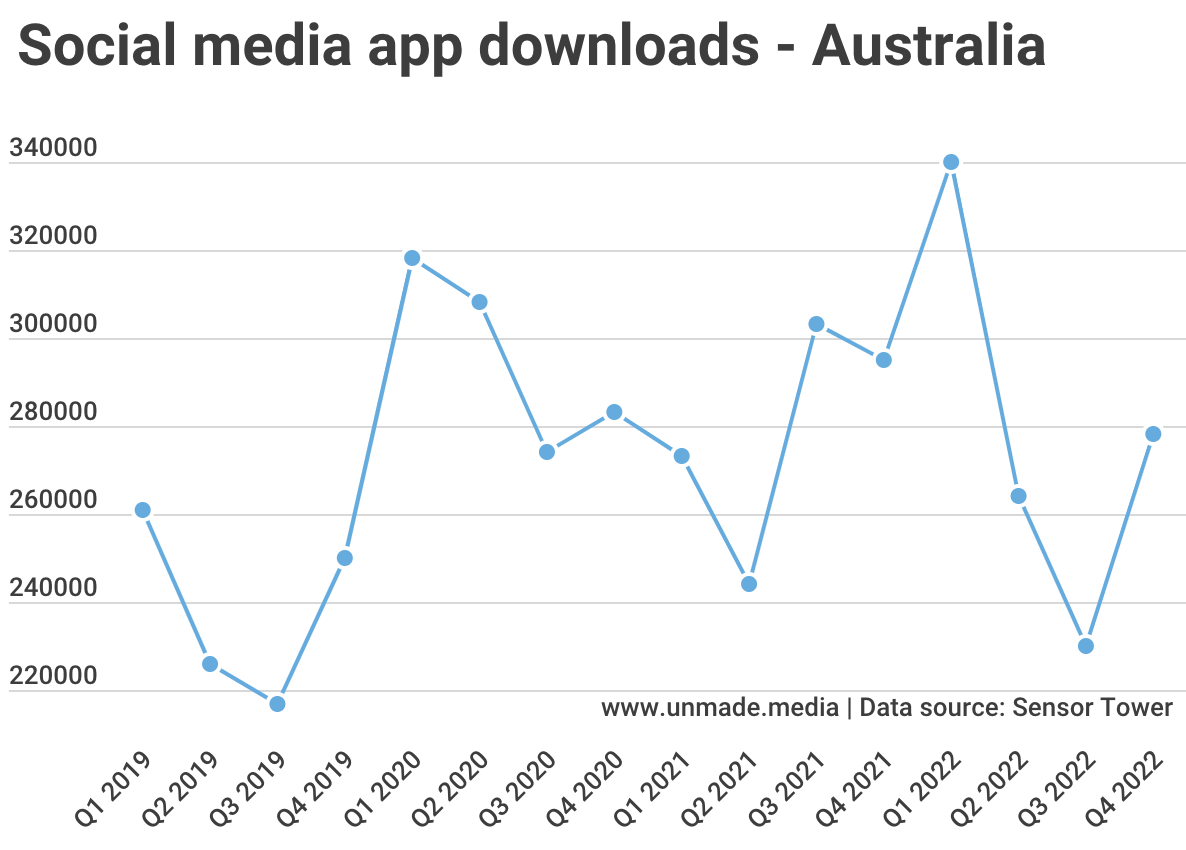

Before we share the graph showing all eight together, we’ll start by pulling out Meta’s two social platforms, Facebook and Instagram.

Last time round, both were fading in terms of new adoption, with two bad quarters in a row.

In the last quarter of 2022, they appeared to turn a corner.

Facebook saw 586,000 local downloads of its app, well up on the previous quarter’s 507,000. And Instagram improved from 439,000 to 480,000.

It was also a similar story for Twitter, with the noise created by Elon Musk’s chaotic takeover perhaps fuelling curiosity.

Twitter improved from 230,000 downloads to 278,000 for the final quarter of 2022.

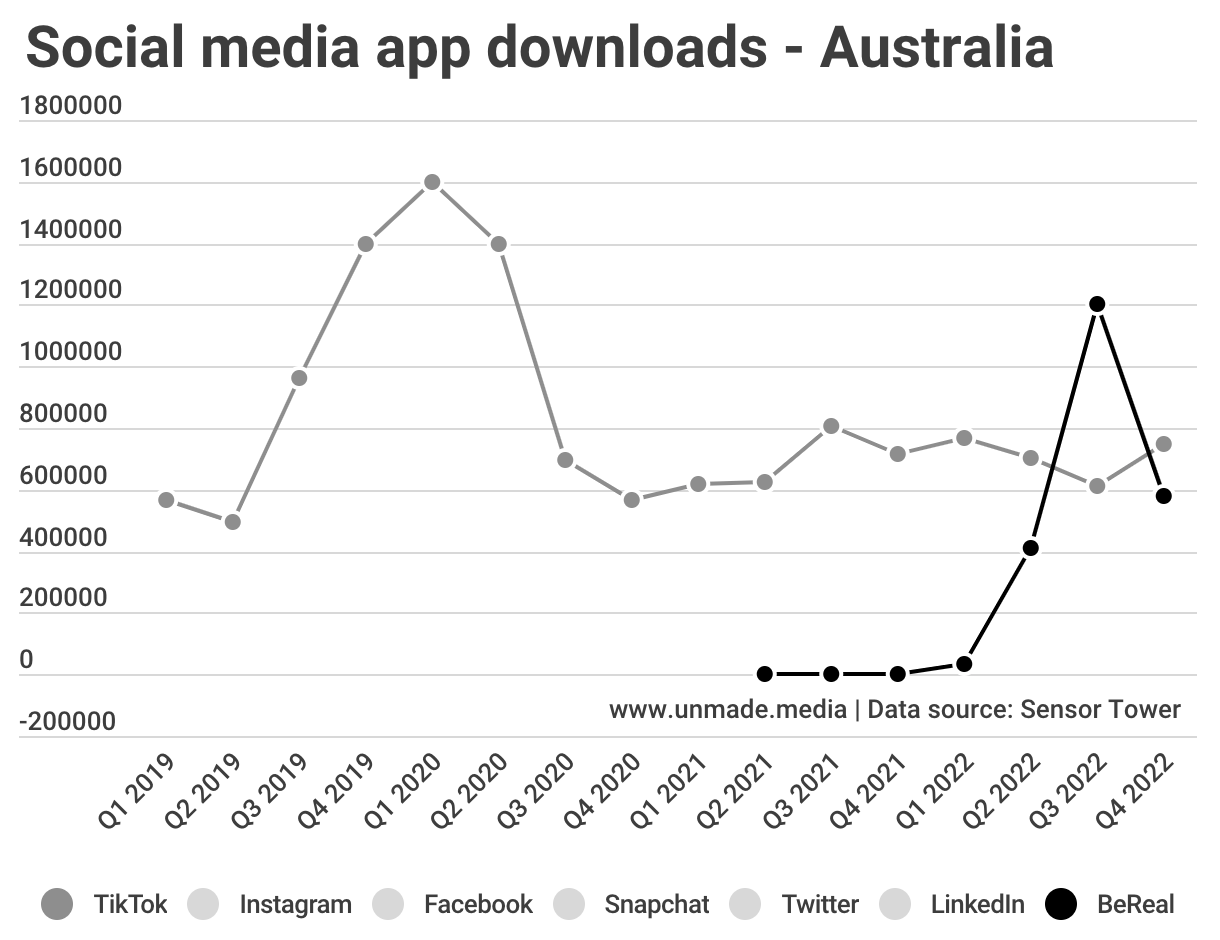

Meanwhile, BeReal may have seen a similar hype cycle to TikTok’s in early 2020, with explosive growth followed by a fall. The third quarter’s BeReal numbers were 1.2m, but fell to 577,000 in the next.

So what of WeAre8, the social media startup created by Australian Sue Fennessy and fronted locally by Lizzie Young?

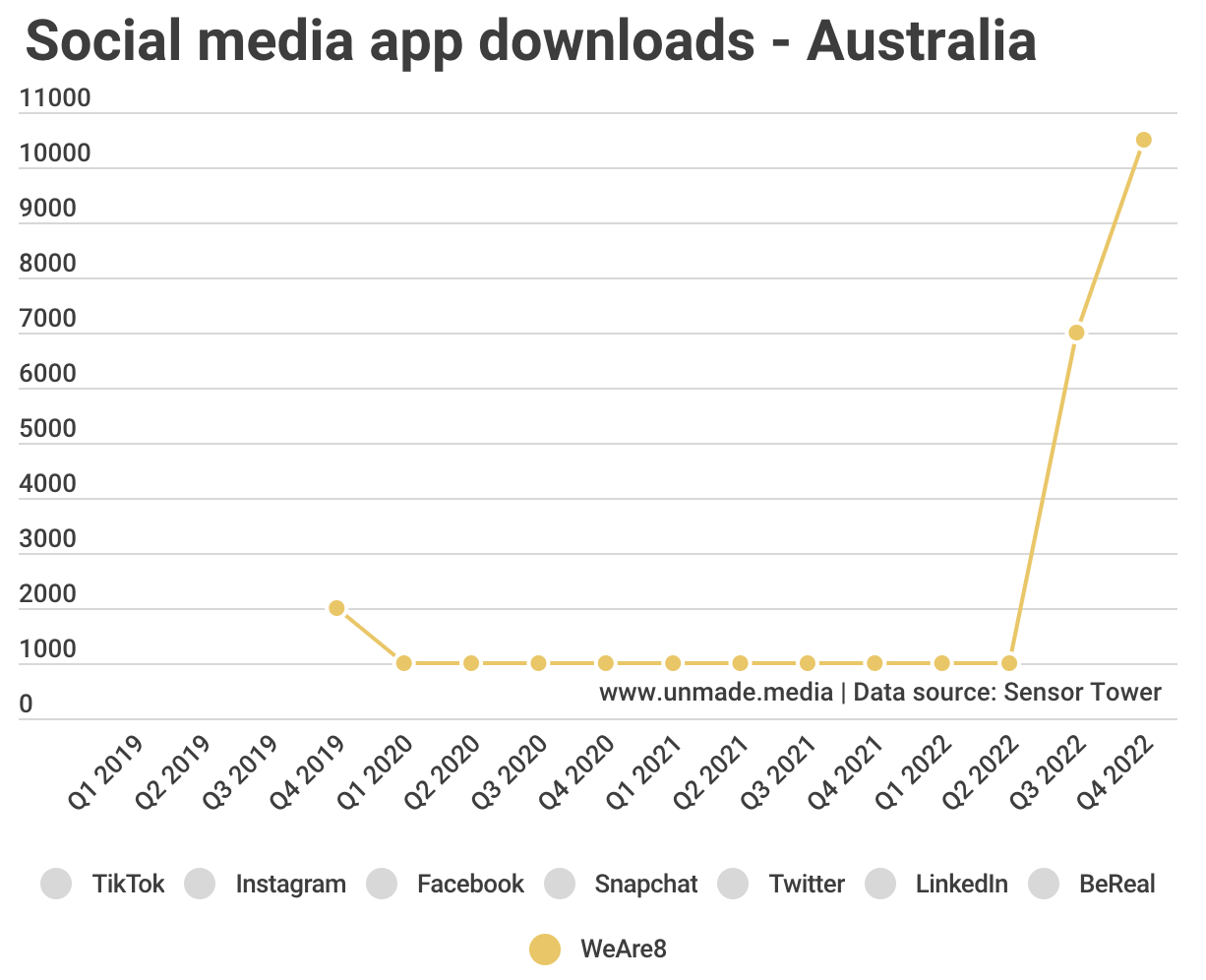

On its own, the WeAre8 growth numbers look impressive.

However, just over 10,000 downloads for the quarter comes against the backdrop of an extensive marketing campaign. Each new signup was acquired at an expenditure of several dollars per user.

Plotted against all the players, the WeAre8 graph looks much less impressive…

Sensor Tower also has data on January’s downloads.

We’ve chosen to illustrate that as a doughnut chart, showing share of downloads.

TikTok was the leader, with more than one in four of the downloads, with Facebook and Instagram following.

Lizzie Young’s request to the market for 6.5% of social media spend for WeAre8 is undermined somewhat by the platform’s 0.23% share of downloads.

There’ll be another edition of Tuesdata next week.

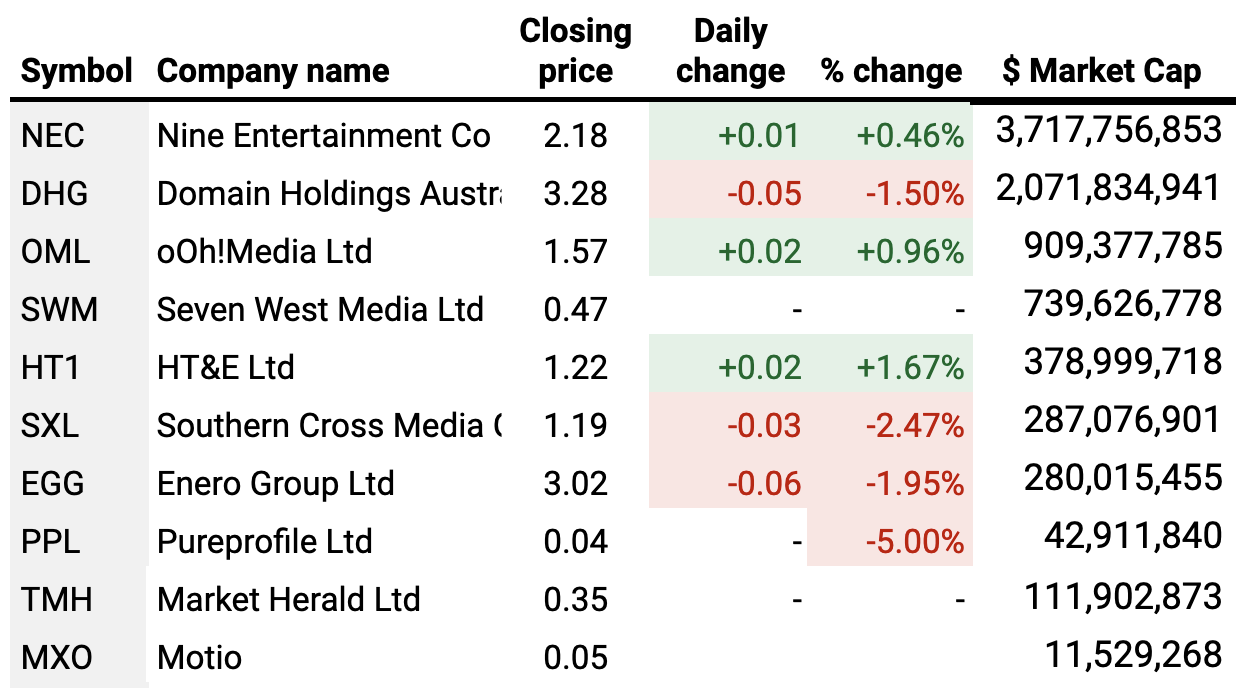

A mixed day on the Unmade Index:

It was a middling Monday on The Unmade Index of ASX listed media and marketing companies.

Unlike last week’s big jumps, there was no obvious direction yesterday, with four stocks falling, three rising and three staying flat. Overall, the index grew by 0.4% to 724.8 points. That was slightly better than the ASX All Ordinaries which fell by 0.3% yesterday.

The biggest movement came from survey house Pureprofile which was down 5%, while ARN’s parent company HT&E rose the most, up by 1.67%.

Time to leave you to your Tuesday. We’ll be back with a midweek update tomorrow.

Don’t forget, as a paying member, you can get two tickets to RE:Made for 30% off. The coupon code you need is: Unmade_Member

Toodlepip…

Tim Burrowes

Publisher – Unmade

tim@unmade.media