Tuesdata: Profits begin to fall as Seven West Media prepares for a chilly 2023

Welcome to a rapid turnaround edition of Tuesdata.

Today we examine the performance on Seven West Media, which this morning released its results for the first six months of the 2023 financial year. Disclosing a slight drop in profit, the company surprised analysts by refusing to disclose its metro revenue share.

The content of the full post is available only to Unmade’s paying members. Today is a good day to join. Not only can you see today’s members-only edition of Tuesdata, but you get access to the full Unmade archive which goes behind a paywall two months after publishing.

Unmade’s paying members also get a 30% reduction in the ticket price for our conference RE:Made – Retail Media Unmade, which is now just a fortnight away, on March 2. The discount code appears at the end of this email, beneath the paywall.

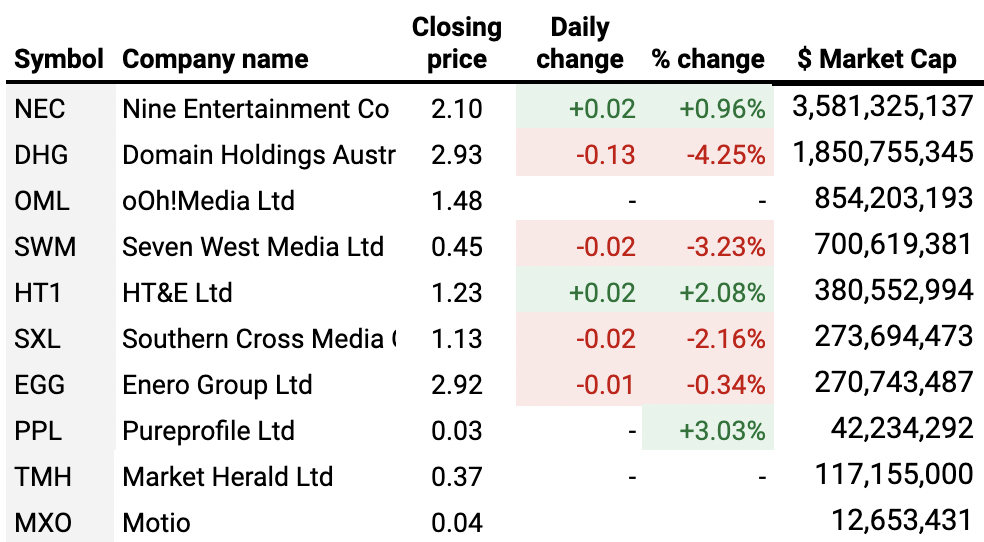

Below, we also wrap up the movement on yesterday’s Unmade Index.

Apart from smoke and mirrors over share, has Seven got any levers left to pull?

Until almost the end of the investor call, it looked like there would be no surprises in this morning’s Seven West Media’s half year update.

There was a sense that with the company fully exposed to a declining advertising market, worse is yet to come. The question is whether that’s a little or a lot worse. That’s the same as all the advertising-led media companies.

Seven West Media’s half year profit of $205m during the period of July to December last year was down nearly 5% on the equivalent period in 2021.

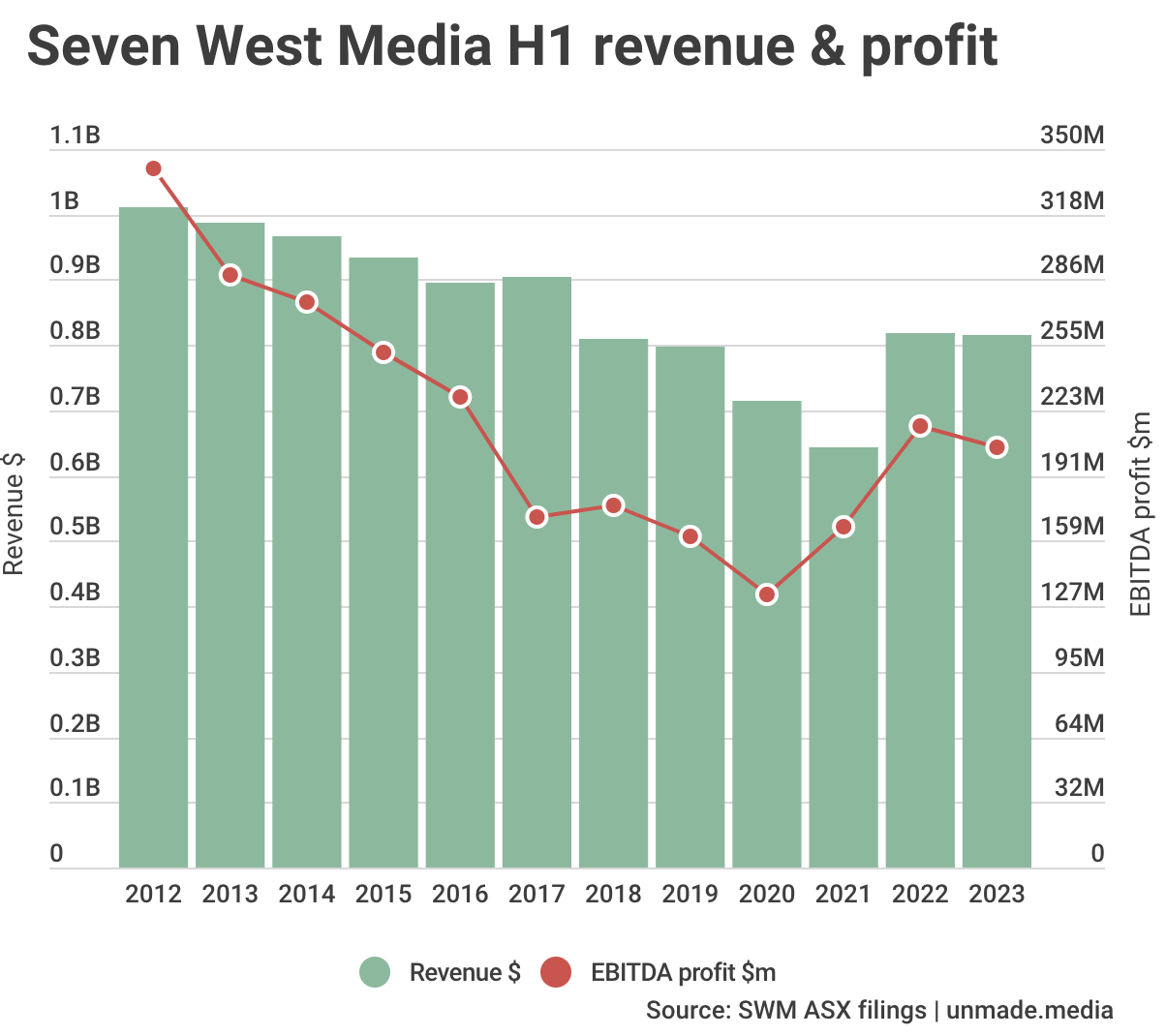

Below the paywall, I’ll be showing how that stacks up against the company’s results over the last decade.

The table above is the comparison of the first half of each financial year, from July to December. Counter intuitively for those who don’t live with accounting terminology, each financial year starts before the calendar turns over. So the numbers reported today were for the first half of FY23

One thing which makes the numbers look better for SWM is its purchase of the regional operations of Prime Media a year ago, which increased the revenue number in comparison to previous years. Even so, the days of doing a billion dollars of revenue in a financial half are well and truly gone.

The most interesting number from today’s presentation was the one that the company did not share.

It announced a “total TV” revenue share of 39.3%. But, for the first time, it did not disclose metro revenue share.

That metro share number has always been the first number the market looks to in order to understand the health of a TV company. Whoever wins metro broadcast share is the real commercial winner. Generally Nine and SWM vie for around 40% each while Ten scraps for the other 20% or so.

The “total TV” number is a less meaningful calculation. While metro and regional broadcast share is a genuine three-horse race (four, if you include SBS), advertising revenue from streaming is spread across a multitude of other services not includes in Seven’s calculation.

By a funny coincidence, last time round when it disclosed both metro share and total TV numbers, the latter was the number Seven did best on. The decision to stop revealing metro share looks rather like an attempt by Seven to mark its own homework.

In the final question of the investor call, analyst Fraser McLeish, from MST Marquee raised the issue, pointing out that analysts build their models around metro share.

Warburton and chief financial officer Jeff Howard both looked uncomfortable at the question, before Howard told McLeish, somewhat defensively: “We’re a total TV network so that’s the number, so sorry.”

Meanwhile, there was other data today. The company’s net debt is now $223m. The debt facility comes due in October next year.

Shareholders were told they won’t be getting a dividend. Payments have now been suspended since 2018.

The company is also looking to cut costs by $15m-$20m. It did not spell out how it would do so.

As this email was being sent, the ASX opened with SWM shares beginning to fall, taking it down to a market capitalisation of $690m.

Unmade Index: How the week began

It was a middling Monday on The Unmade Index, as the market waited for reporting season to get fully underway.

Monday’s speculation of some kind of deal involving ARN owner HT&E and Seven West Media, appeared to have an opposite effect on the two stocks. HT&E rose by 2.1%, while SWM dropped by 3.2%, suggesting the investment market doesn’t love the idea of SWM being an acquirer.

The movement left SWM teetering just above the $700m market capitalisation milestone on Monday evening.

Time to leave you to your Tuesday. We’ll be back with a midweek update tomorrow.

Don’t forget, as a paying member, you can get two tickets to RE:Made for 30% off. The coupon code you need is: Unmade_Member

Toodlepip…

Tim Burrowes

Publisher – Unmade

tim@unmade.media