Tuesdata: Which health insurance brand is currently spending the most?

Welcome to Tuesdata, our weekly look into the most interesting data from the media and marketing industry.

This post is for Unmade’s paying members. If you want to get the full story and gain access to our Tuesdata archive, not to mention all the other benefits paying membership provides, click the button below.

A large portion of Australia’s health system continues to be under significant pressure. While society may have moved to ‘living with Covid’, the national hospitals still have to treat those too sick to ride out the symptoms at home.

Victoria in particular has seen significant pressure on its hospital system. But the nation as a whole is keeping one hand firmly hovering above the panic button as Covid-19 hospitalisations reach and all-time high.

The constant coverage of the hospital situation has put health and wellbeing well and truly in the spotlight. With that in mind, it’s an appropriate time to take a look at which health insurance brands have decided to turn up their marketing spend.

This week we will reveal the top five health insurance brands for July in terms of their advertising spend according to Nielsen Ad Intelligence.

Last time we revealed Nielsen Ad Intelligence figures it was for cold and flu products as we hit the middle of winter. Spend by health insurance brands is, of course, significantly bigger.

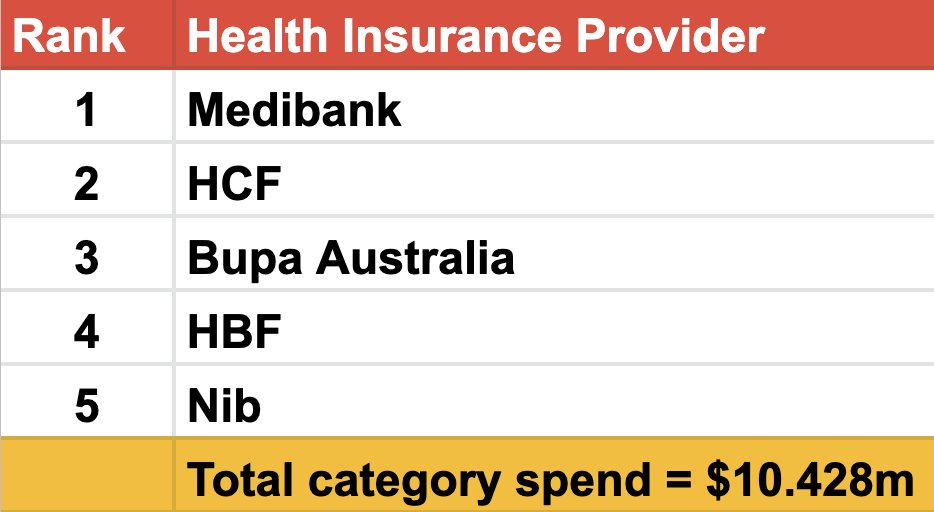

In July, the entire health insurance category recorded $10.428m in advertising spend. Below we will reveal the top five in spend order.

The top spending brands in the health insurance category for July

1. Medibank

Unsurprisingly, if you read the trade press regularly, Medibank has topped the spend chart for health insurance providers for July.

The brand has been particularly active, including a new brand positioning and visual identity as well as the extension of its ParkRun sponsorship.

‘You’re only human’, was the fresh brand positioning, created by new partner Colenso BBDO out of New Zealand. It was launched via a fully integrated campaign that included TV and outdoor.

The brand continues to use its ‘Live better’ slogan and logo design. Marketing is lead by Fiona Le Brocq.

2. HCF

HCF continues to push hard with its ‘Uncommon care’ platform and creative. There is an irony that the current work in market was the first for the brand from Clemenger BBDO. It happens to be sister agency to Medibank’s creative partner Colenso BBDO.

The campaign, which extended the already released platform, ran across media including TV, OOH, radio, social and digital.

Tatiana Papavero is the head of advertising and operations at HCF.

3. Bupa Australia

Bupa is currently in market with its ‘Before life happens’ platform, a product of its collaboration with Thinkerbell.

The relationship is more established than both of the ones already mentioned, with the agency having begun work with the health insurer in December 2020.

Thinkerbell has also created the ‘FLEXtras’ campaign for the brand, highlighting the flexibility of choice for customers when it comes to optional extras.

Naomi Morton is Bupa’s general manager of marketing.

4. HBF

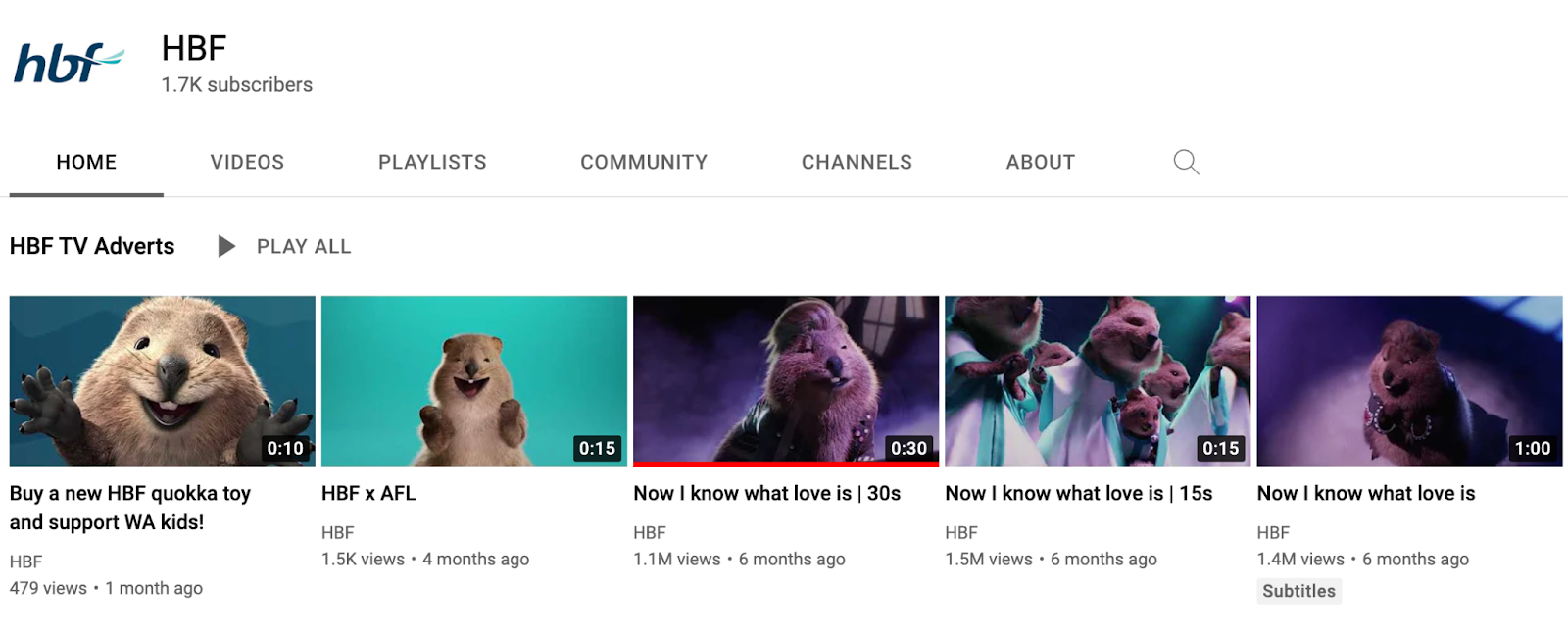

The quokkas continue their march for West Australian-based HBF, having been introduced prior to the last agency pitch in late 2020 by Leo Burnett, who nows leads the brands creative work. At the time Leos serviced the HBF east coast account while Cummins & Partners handled the west coast.

HBF marketing boss Louise Ardagh will do well to keep the quokkas going, having picked up significant traction online. Three of those ads have attracted between 1.1 and 1.5 million views on YouTube, compared to a few hundred views on most its other content.

5. Nib

Similar to Medibank, Nib has been going through somewhat of a change lately. In January this year it launched a brand refresh via Landor & Fitch before releasing the first campaign from new creative partner BWM Dentsu.

It was a big change for the brand which had used Saatchi & Saatchi since 2013 before the shift. The change was led by Nib head of marketing Chris Donald.

Down, down, values are down

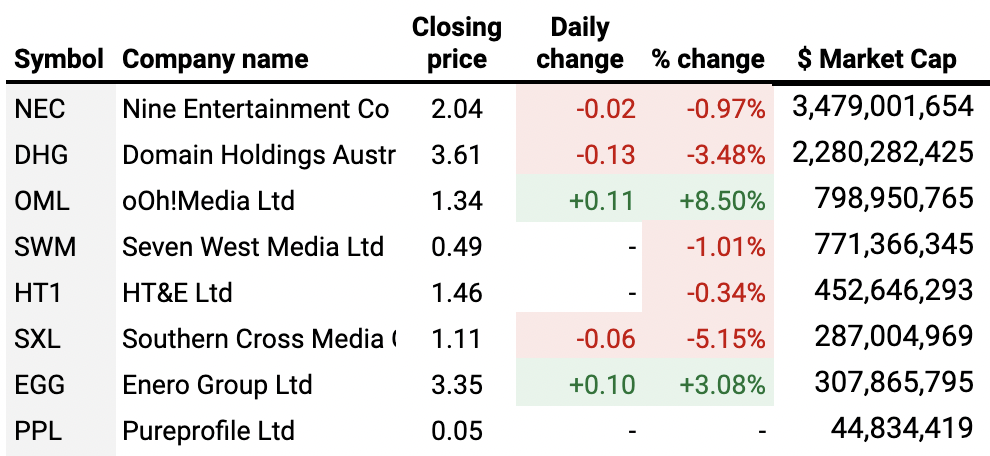

Another Unmade Index report, another small drop. Of the last five business days all but one have recorded drops less than a percent. The day that was different was a bigger 1.67% drop.

Enero Group was the significant gainer, up 3.08%, but it’s SCA in the doldrums, recording a 5.15% drop a day after announcing its FY22 results. It now has a market cap under $300m. You can find the results press release here.

A bit Slack

For those of you who might have missed it, my colleague Tim Burrowes put out a request in Saturday’s Best of the Week. You can read it here, but the crux of it was asking whether or not you would be interested in Unmade running a Slack channel for paying members.

Being that if you’re reading this part of today’s post, you are most certainly a paying member, we would very much appreciate your feedback. Let us know what you think by emailing letters@unmade.media.

Righto, time to step away from the computer and get into the real world for some industry conversation. Whatever you’re doing today, I hope it’s enjoyable.

Stay safe,

Damian

damian@unmade.media