What PayPal’s retail media pivot means for brands; Media stocks lift from their low

Welcome to the latest edition of the REmade newsletter, sister publication to our REmade conference, where the retail media community comes together.

Today, our columnist Colin Lewis explains why PayPal’s new retail media network heralds a trend of companies leveraging rich first party data to reach customers, and we round-up of the latest moves in retail media.

Plus

If you’ve been thinking about upgrading to an Unmade membership, this is the perfect time. Your membership includes:

Member-only pricing for REmade (October 1);

A complimentary invitation to Unmade’s Compass event (November);

Member-only content and our paywalled archives;

Your own copy of Media Unmade

What’s new in retail media:

REmade conference curator Cat McGinn writes,

As we’re developing the program for our third edition of REmade – Retail Media Unmade on October 1, the sector shows no sign of coming off the boil. If you have a brilliant case study, new research or a topic that would be valuable to our audience, please let us know. We’re also keen to hear your thoughts on our fledgling Retail Media Awards which launched across four categories in 2023. Please reach out to conference curator Cat McGinn.

The RM rollercoaster

A new WARC report forecasts another meteoric year of retail media investment globally, with an increase of 13.7% year on year to hit $153.3 billion by the end of 2024. However predictions indicate growth will ease off to 10.6% in 2025, as trade budgets become fully committed.

Amazon is the centre of gravity with over 60% of all retail media spend in all markets other than China, where Temu’s owner Pinduoduo dominates.

New kids on the retail media block

Capitalising on the breadth and depth of their first-party data, a number of new players have entered the retail media arena in the US. From the launch of United Airline’s Kinective Media℠, PayPal Ads, T-Mobile and Chase Bank, these non-traditional retail media networks are well placed to target customers across the buying journey, increasingly essential in a cookieless world.

New retail media models and emerging alliances

Retailers have been adding to their in-store and off-site capabilities, through tech partnerships and streamlined reporting systems.

US retailer Walmart is intending to buy consumer electronics manufacturer Vizio, giving the retail giant access to streaming TV inventory and hardware for 18 million customers in the US. CNET and Best Buy announced a partnership to share inventory and audiences. These moves echo Amazon’s merging of deep personalisation capabilities with content, as Amazon launches ads in Australia on its VOD platform Prime Video.

HOLD THE DATE

REmade returns October 1

What PayPal’s advertising pivot means for marketers

In his regular column for REmade, global retail media consultant Colin Lewis explains what the launch of PayPal Ads means for brands

The new non retailer retail media networks

Online payments company PayPal is developing an advertising sales business built on the vast amount of data collected from tracking the purchases and spending habits of its users.

To lead this new initiative, PayPal Ads has brought on Mark Grether as General Manager. Grether is a major player in the space, He previously took Uber Advertising from zero to over $US900m in just four years and before that was director of Amazon Advertising.

PayPal’s aim is to sell advertisements not only to its existing partners but also to external advertisers who do not sell products through PayPal. PayPal Advertising is one of the newer networks that can really offer retail media-like propositions to non-endemic advertisers. Non-endemics are brands that do NOT sell with retailers to whom they advertise. For example, if you were a grocer with great first party customer data, you might be able to target sectors from financial services to travel; telco to automotive to office materials by saying “we have great audience data and you can advertise against it”.

Why advertising? The majority of PayPal revenue comes from transaction fees (90.4%) while revenue from other value-added services accounts for only 9.6% of revenue. Advertising provides a high-margin scaleable business that has a USP that is attractive to advertisers; in the press release, PayPal claims its data could provide insights into purchasing behaviour both online and in physical stores.

In January, PayPal launched Advanced Offers, its first advertising product that leverages AI and user data to help merchants target PayPal users with personalised promotions and discounts. This product only charges advertisers when a purchase is made, and it is currently being tested by online marketplaces eBay and Zazzle.

PayPal: size is what makes it attractive

In a cookieless world, first party data is more interesting. PayPal is yet another walled garden like Meta or Amazon which have become publishers with an ad network. These companies have an incredibly rich data set; their services mean they are more a part of people’s lives than you’d think.

In the first quarter, PayPal processed 6.5 billion transactions from about 400 million customers, according to their latest earnings report.

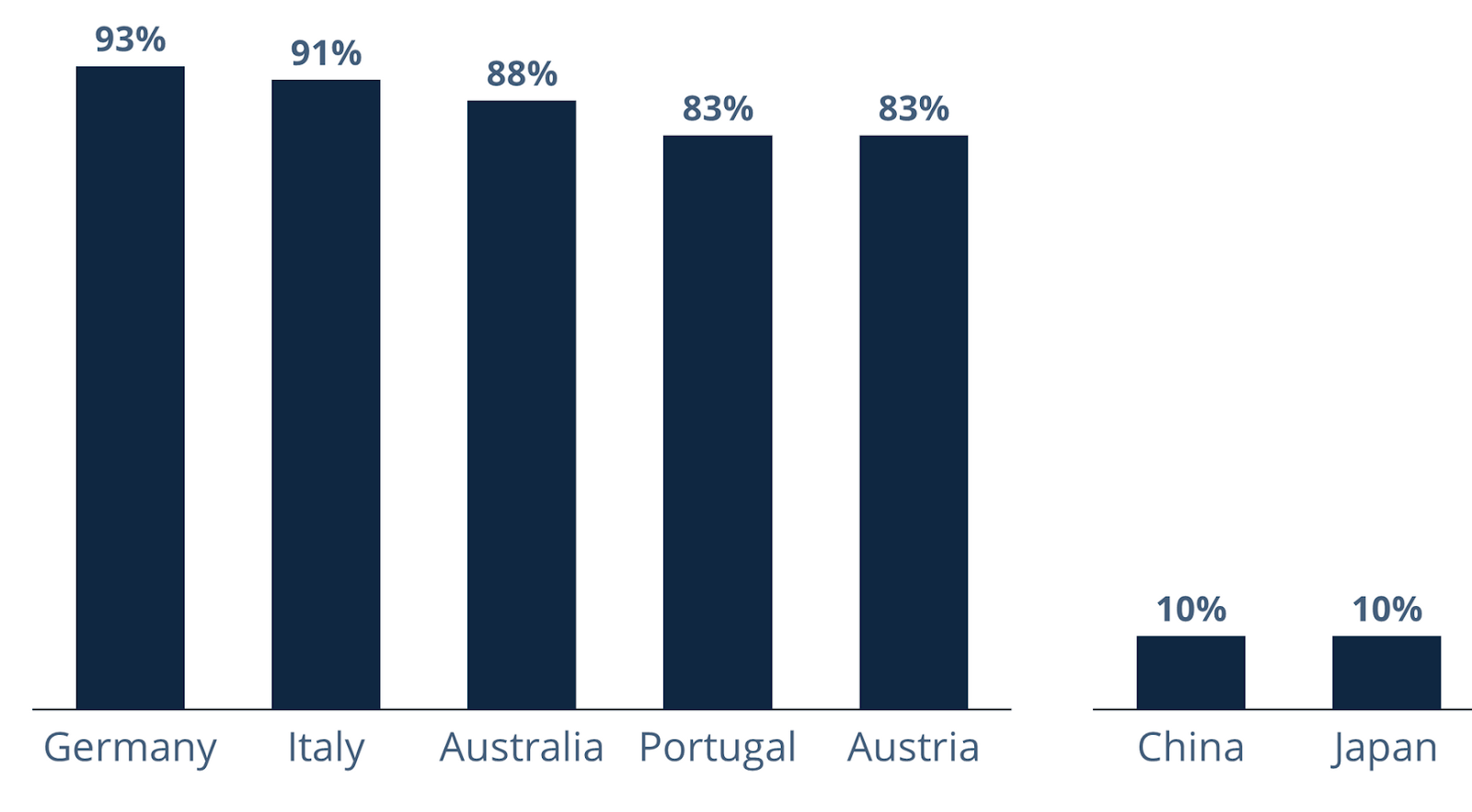

Some 36m merchants use PayPal in over 165 countries worldwide. Indeed, in certain countries, penetration of PayPal with eCommerce is over 80%. In Australia the number is 88%.

PayPal also owns Venmo, a mobile payment service that so far only operates in the US. Venmo allows account holders to easily send money to each other through a mobile app. Venmo has more than 85m users with more than $298 billion in volumes. PayPal has started showing some untargeted advertising on Venmo.

More ad networks are coming

Many non-retailers are building ad networks using customer data to target ads for marketers.

In Europe, Revolut – one of the many app-only banks that have taken Europe by storm – is also planning an advertising sales network. It has hired a TikTok executive to lead a ‘media strategy’ as it seeks to diversify revenues

Revolut’s head of growth Antoine Le Nel told the Financial Times: “Revolut could become a media business . . . a place where you have an audience and data about the audience and you monetise this. We could in the near future derive a “proper chunk” of its total revenue from targeted advertising. We know how users navigate inside the app, we know some of their interests that they have because they’ve clicked on this and that.”

Revolut has hired a sales team of about 30 people for its media strategy and has an internal target for revenue derived from advertising of about £300m (roughly AU$580m) by 2026. Its entire business generated revenues of £923m in 2022.

Why here and now? Andrew Lipsman, founder of consulting firm Media, Ads + Commerce points out: “Financial services companies need substantial growth in ad sales to impact their overall financial performance, as their primary businesses generally have higher profit margins than retail chains. These sorts of media networks could potentially charge higher ad rates than some retail networks due to its detailed consumer data. For instance, PayPal might group consumers by their relative affluence, or their status as business travellers”.

Takeaways for Aussie Brands:

With the stop/start ‘death of the third party cookie’ and privacy laws, those who have great first party data are winners. So, there is an air of inevitability about new ‘commerce networks’ based not just on retailer data.

Payment providers have lots of details of purchase behaviour across brands, merchants and shopping verticals – both online and in-store transaction data. It’s hard to resist the urge to monetise this as a new revenue stream for the likes of NAB or CBA.

London media legend Nick Manning wrote recently that “We are witnessing the full-scale emergence of a new way to drive business and new marketing models, and this will have a profound influence on the marketing services industry and hence the agency world.”

PayPal, Revolut et al launching ad networks is part of this. More channels, more choice. It’s all a far cry from selecting from Seven, Nine or Channel 10, buying on Austereo and choosing between Fairfax and Murdoch titles.

Unmade Index

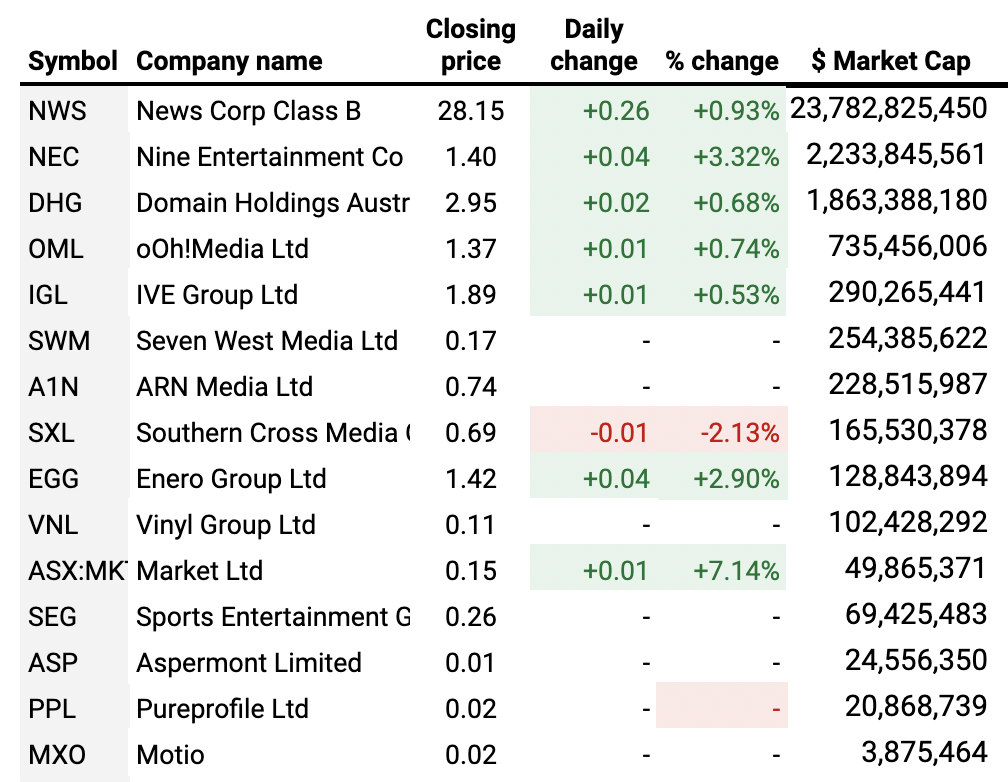

The Unmade Index bounced back from Wednesday’s all-time low, moving back up to 480.9 points with a lift of 1.84% yesterday. That outperformed the wider ASX All Oridnaries which was up by 0.5% on Thursday.

Our index of the ASX’s listed media and marketing companies was lifted by Nine which rose by 3.32%, taking it back over a $2.2bn market capitalisation.

The only stock to sink some more was Southern Cross Austereo which lost another 2.13% to hit another all-time low, with its market cap falling to $165m.

Time to leave you to it. We’ll be back with Best of the Week tomorrow morning. Among other things I’ll be trying to figure out what this week’s collapse of the leading takeover deal for Paramount means for the Australian operation (spoiler alert: the answer may be: Too early to tell).

Toodlepip…

Tim Burrowes

Publisher – Unmade

tim@unmade.media